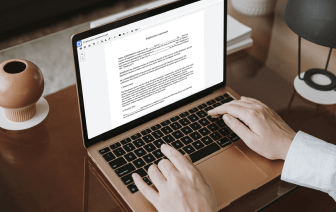

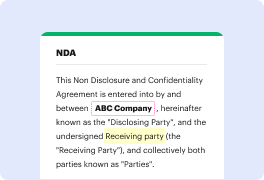

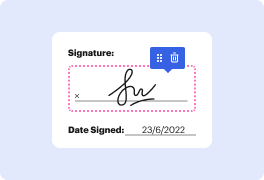

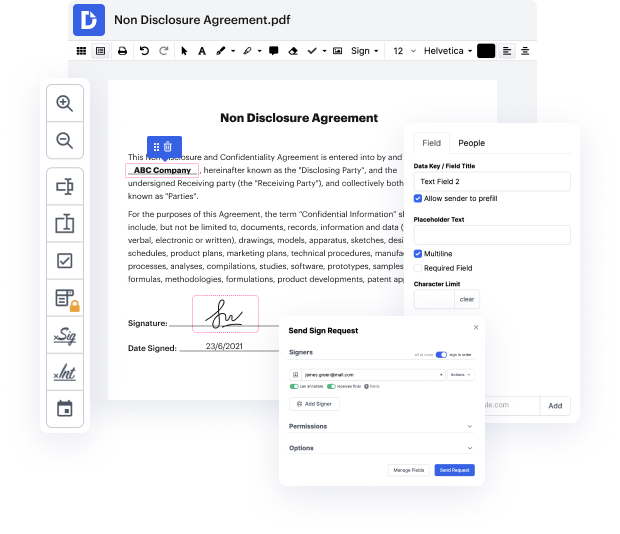

The challenge to manage Repurchase Agreement can consume your time and overwhelm you. But no more - DocHub is here to take the hard work out of altering and completing your documents. You can forget about spending hours editing, signing, and organizing papers and worrying about data protection. Our solution offers industry-leading data protection measures, so you don’t need to think twice about trusting us with your privat data.

DocHub works with different file formats and is available across multiple systems.

[Music] repurchase agreements are another important source of funding not only for banks but also for other market participants a repurchase agreement or repo is an arrangement by which one party sells a security to account a party with a commitment to buy it back at a later date at a specified price so in effect the buyer is actually lending funds to the seller with a security as collateral on the repurchase date the seller which is the borrower is supposed to pay the lender the repurchase price in order to obtain back collateral security a repo for one day is called an overnight repo while an agreement covering a longer period is called a term repo the repurchase price is greater than the selling price and accounts for the inches charged by the buyer the interest rate implied is called the repo rate which is the annualized percentage difference between the repurchase and selling prices repos are popular because the interest cost of a repo is usually less than the rate on bank loans o