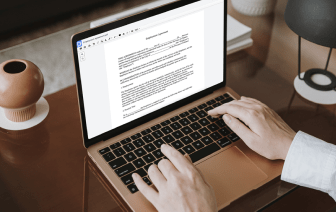

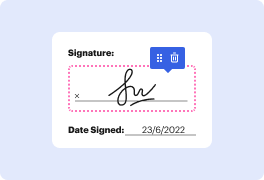

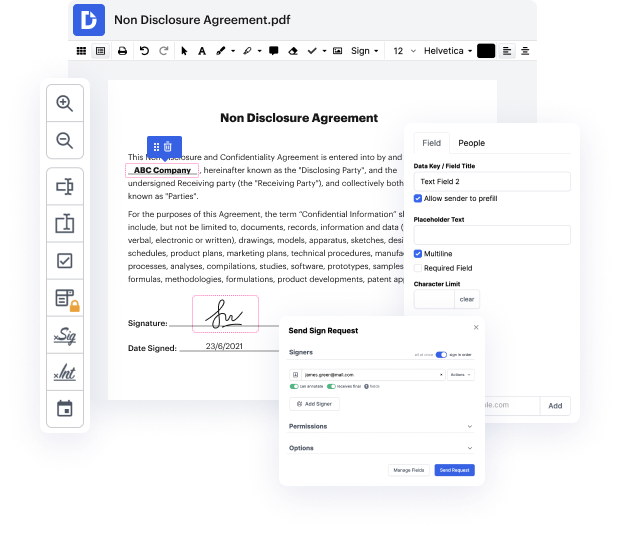

Document-centered workflows can consume a lot of your time and energy, no matter if you do them regularly or only sometimes. It doesn’t have to be. The truth is, it’s so easy to inject your workflows with additional productiveness and structure if you engage the proper solution - DocHub. Sophisticated enough to handle any document-connected task, our software lets you modify text, pictures, comments, collaborate on documents with other users, create fillable forms from scratch or web templates, and digitally sign them. We even safeguard your data with industry-leading security and data protection certifications.

You can access DocHub tools from any place or device. Enjoy spending more time on creative and strategic work, and forget about cumbersome editing. Give DocHub a try right now and see your Repurchase Agreement workflow transform!

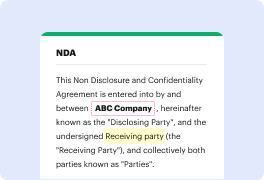

In a scenario where Bank A needs cash quickly and owns bonds, it can engage in a repurchase (repo) agreement with Bank B, which has excess cash. In this arrangement, Bank A, referred to as the dealer, provides its bonds to Bank B and agrees to buy them back shortly after, usually the next day, at a higher price. This transaction allows Bank A to access the cash it needs while Bank B earns a profit from selling the bonds back at the predetermined higher price. From Bank A's perspective, this is a repo, while Bank B sees it as a reverse repo. Repo transactions are commonly utilized by banks, mutual funds, hedge funds, and even central banks.