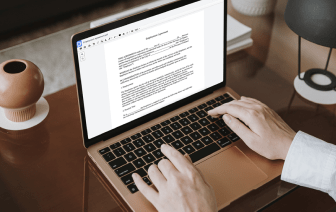

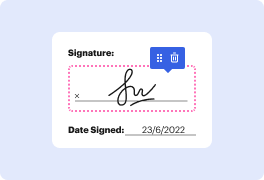

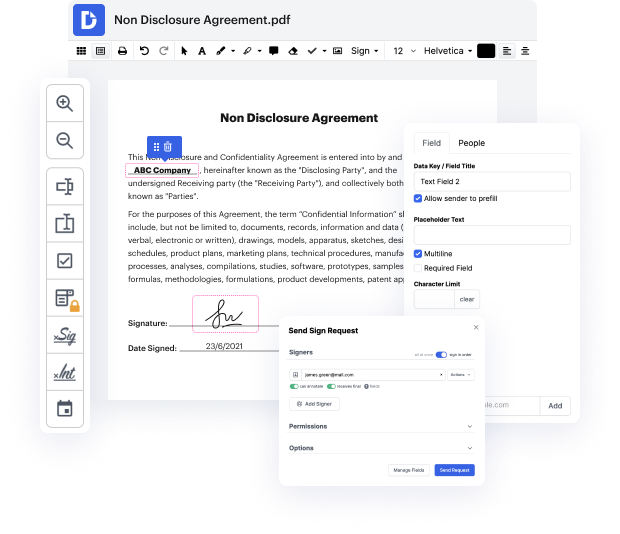

Do you want to prevent the challenges of editing Tax Agreement on the web? You don’t have to worry about installing unreliable services or compromising your documents ever again. With DocHub, you can shade name in Tax Agreement without spending hours on it. And that’s not all; our user-friendly solution also provides you with highly effective data collection tools for gathering signatures, information, and payments through fillable forms. You can build teams using our collaboration capabilities and efficiently work together with multiple people on documents. Additionally, DocHub keeps your data safe and in compliance with industry-leading protection requirements.

DocHub enables you to use its tools regardless of your system. You can use it from your laptop, mobile device, or tablet and edit Tax Agreement effortlessly. Begin working smarter today with DocHub!

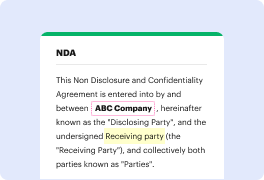

good morning my name is Fletch Hyneman Im a partner at Cooper great sward specializing in tax and tax disputes if youre an Australian expat living and working overseas one of the most important considerations with respect to your residency position is whether there is a double tax agreement between Australia and the country that youre living and working what we see is that the ATO is often taking a position that if somebody has connections with Australia they continue to reside in Australia and therefore continue to be a tax resident of Australia for Australian income tax purposes however often those clients will also be tax residents of the country that theyre living and working overseas and if there is a double tax agreement between Australia and that country that double tax agreement then overrides the Australian domestic law to the extent that theres any inconsistency this can sometimes make it easier to help determine whether somebody is actually in Australian tax residence i