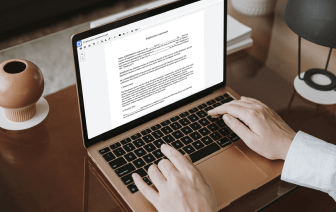

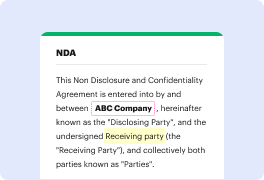

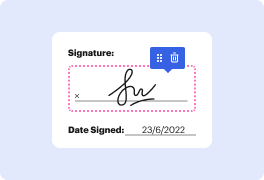

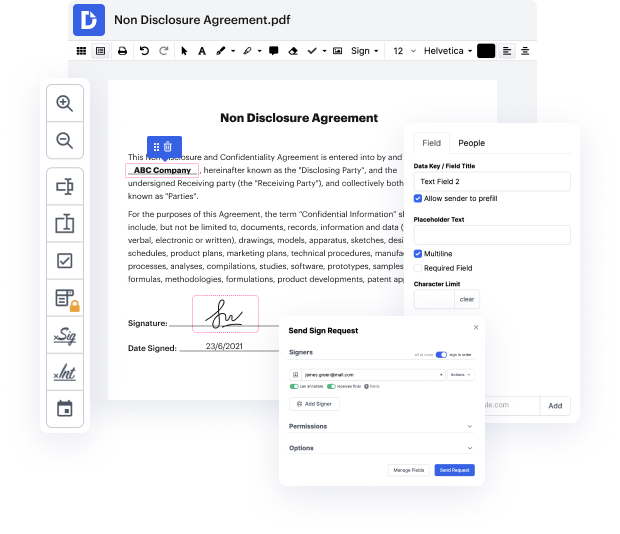

Whether you work with papers day-to-day or only from time to time need them, DocHub is here to assist you take full advantage of your document-based projects. This tool can shade guide in Profit Sharing Plan, facilitate collaboration in teams and generate fillable forms and valid eSignatures. And even better, everything is kept safe with the highest protection standards.

With DocHub, you can access these features from any location and using any device.

if youre like many business owners youve probably heard of profit sharing and you may have also wondered what the heck is it and why would i do it in my business uh this video is going to tell you a little bit about why it might be a good idea why it might actually increase your profit and some pitfalls too so how it can go terribly terribly wrong [Music] [Applause] hi im joe collins from avalon accounting so lets get into profit sharing what it is and how it can work for your business so profit sharing is popular with small businesses and large businesses and its popular for a reason so im going to get into some of the benefits of what profit sharing can do for your business if done correctly so the benefits of profit sharing are that youre going to have engaged employees that really care about your business because you know in the end we care about ourselves so if theyre going to see more profit gives them more money in their pocket theyre going to do activities that hopeful