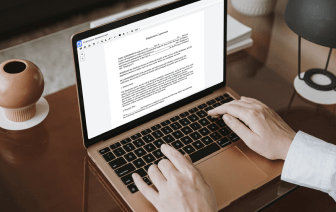

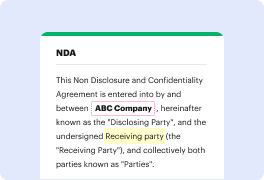

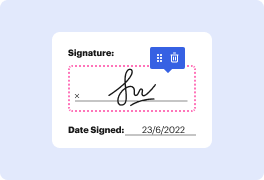

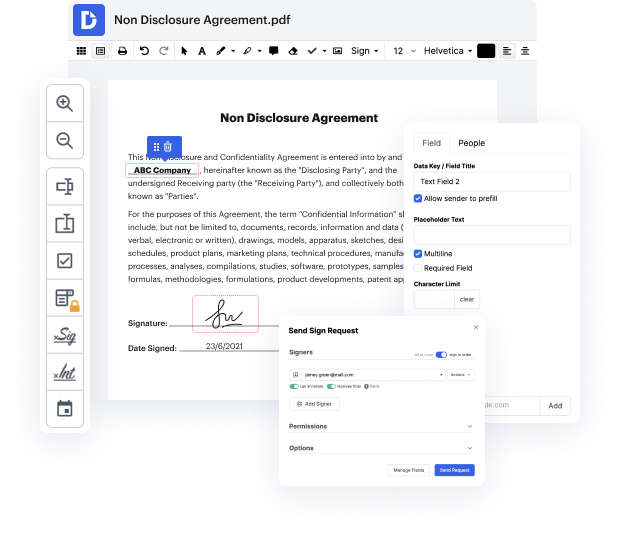

The struggle to manage Retirement Agreement can consume your time and overwhelm you. But no more - DocHub is here to take the hard work out of altering and completing your papers. You can forget about spending hours adjusting, signing, and organizing paperwork and worrying about data security. Our platform provides industry-leading data protection measures, so you don’t need to think twice about trusting us with your sensitive info.

DocHub works with different file formats and is accessible across multiple systems.

In this podcast episode, the hosts discuss the concept of "retirement in action," emphasizing the importance of implementing effective retirement plans. They focus on taking insights from professional practice and interviews to create actionable strategies. One host, Murs, highlights the significance of a comprehensive retirement plan that encompasses all aspects of an individual's financial situation. He elaborates on the planning process, particularly regarding retirement income, and the benefits it brings to clients, enabling them to effectively apply these strategies in their own planning. The discussion aims to provide clarity on how to approach retirement planning holistically.