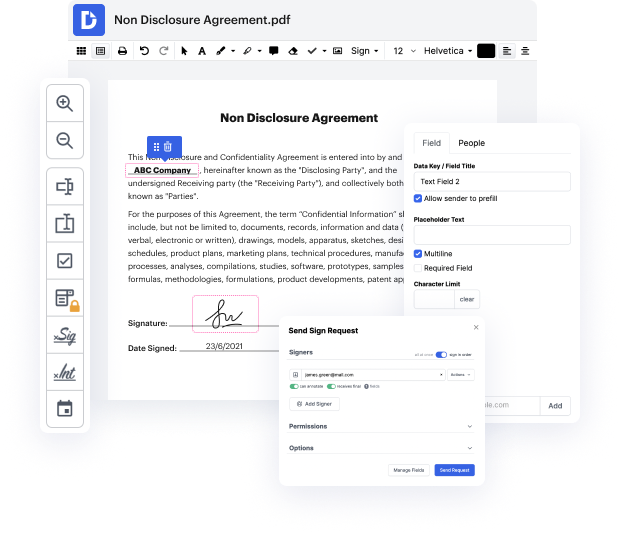

Most companies ignore the benefits of complete workflow software. Typically, workflow apps concentrate on one aspect of document generation. You can find better choices for many sectors which require an adaptable approach to their tasks, like Credit Agreement preparation. But, it is possible to find a holistic and multi purpose solution that can deal with all your needs and requirements. For example, DocHub can be your number-one option for simplified workflows, document generation, and approval.

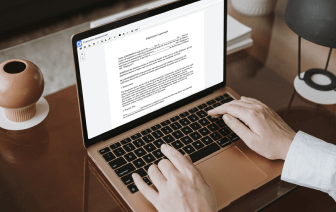

With DocHub, it is possible to make documents completely from scratch by using an vast list of tools and features. It is possible to quickly set contents in Credit Agreement, add feedback and sticky notes, and monitor your document’s advancement from start to end. Quickly rotate and reorganize, and merge PDF documents and work with any available file format. Forget about seeking third-party platforms to deal with the most basic demands of document generation and utilize DocHub.

Take full control of your forms and documents at any time and create reusable Credit Agreement Templates for the most used documents. Benefit from our Templates to avoid making typical errors with copying and pasting exactly the same info and save time on this tiresome task.

Simplify all your document procedures with DocHub without breaking a sweat. Discover all possibilities and functionalities for Credit Agreement management today. Start your free DocHub account today with no concealed fees or commitment.

welcomes at the five-minute legal master series were expert attorneys help you master important legal topics today board-certified creditors rights attorney Nicholas D Kralik discusses credit agreements welcome today I want to talk to you a little bit about credit agreements you know in the euphoria of getting a new customer not many creditors especially their sales departments want to think about their customer becoming a debtor somewhere down the line however when a creditor extends credit to that new customer hes essentially lending his companys money and there is a risk that the creditor may not get paid by this customer therefore the outset of the business relationship with a new customer that is precisely the time to be proactive to anticipate what rights and remedies you as the credit grantor will want and need to have at your disposal if and when the new customer becomes a non-compliant debtor youve got to prepare for collection from day one and nobody likes to think about