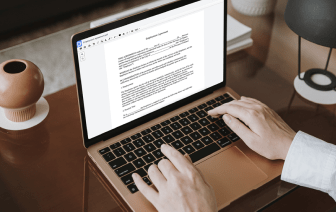

When you deal with different document types like Form W-8BEN, you understand how significant precision and attention to detail are. This document type has its specific structure, so it is essential to save it with the formatting undamaged. For this reason, working with this sort of documents can be quite a struggle for traditional text editing applications: one incorrect action might ruin the format and take extra time to bring it back to normal.

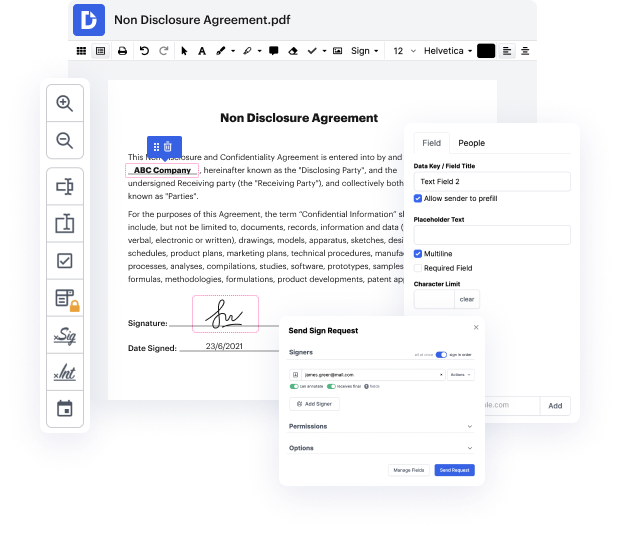

If you wish to set account in Form W-8BEN without any confusion, DocHub is a perfect tool for such duties. Our online editing platform simplifies the process for any action you may need to do with Form W-8BEN. The streamlined interface design is suitable for any user, whether that individual is used to working with such software or has only opened it the very first time. Gain access to all editing tools you require quickly and save your time on daily editing activities. You just need a DocHub profile.

See how effortless document editing can be irrespective of the document type on your hands. Gain access to all top-notch editing features and enjoy streamlining your work on documents. Register your free account now and see immediate improvements in your editing experience.

Hello, everyone on YouTube, Jim Baker here . Making a video today about form W8BENformW-8BEN-E informed W9 more specifically about form W8BEN because I get so many questions about this form. Because it's so confusing. And because I want to, I'm hoping to clarify a little bit of it for everyone here. So I have, I'm making a video and I'm going to break it into three sections. I might chop it up into three different videos. And if so, I'll have the links to the second and the third video link below. And they should all come out at the same time. Cause I'm going to film it all at once. I think chop it into three videos cause it might get a little long. Okay. So the first video. What is form W-8BEN-E and why do I have to file it? Or I guess it's more appropriate to say, why do I have to complete it? Right. So the first thing I want to share is that for these forms are to certify and to verify your US tax withholding status. And you can see at the top of every form and I'll open them up f...