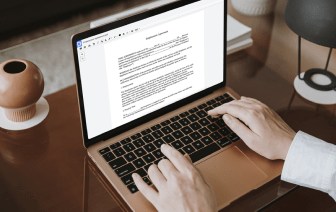

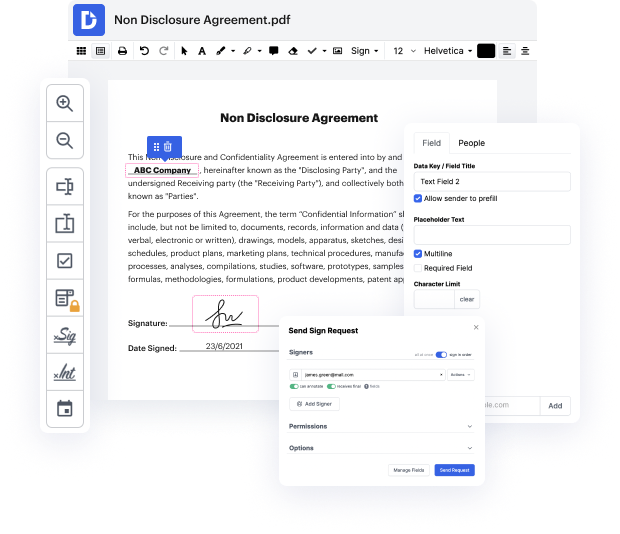

Manual file handling can be a reason behind your company burning off funds as well as your employees losing interest in their commitments. The easiest way to accelerate all business processes and boost your data would be to take care of everything with cutting-edge software like DocHub. Handle all of your documents and Save Independent Contractor Agreement in Excel in a matter of mere seconds and save more time for pertinent tasks.

With DocHub, you possess unlimited use of your documents and Templates available for you at any moment. Explore all features today with the free of charge DocHub account.

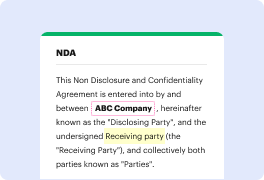

In this episode of "All Up in Your Business," attorney Aiden Kramer discusses independent contractor agreements. He explains that an independent contractor performs services for a business without being an employee, providing the example of hiring a bookkeeper. It's essential to have a written agreement that outlines the relationship between the business and the contractor. Key terms to include in the agreement are the specific services the contractor will provide and the payment details, clarifying how much the contract is worth. This ensures both parties understand their roles and obligations.