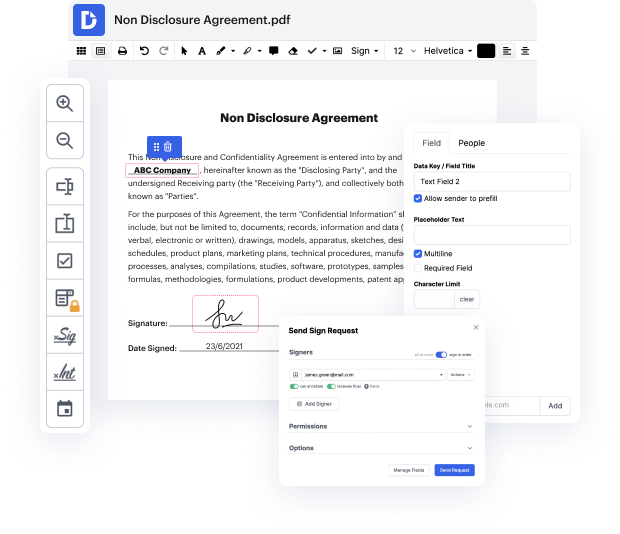

Many people find the process to rework ein in ASC quite daunting, particularly if they don't regularly deal with paperwork. Nonetheless, nowadays, you no longer have to suffer through long guides or spend hours waiting for the editing app to install. DocHub lets you modify forms on their web browser without setting up new programs. What's more, our robust service offers a complete set of tools for comprehensive document management, unlike numerous other online tools. That’s right. You no longer have to donwload and re-upload your forms so frequently - you can do it all in one go!

No matter what type of document you need to adjust, the process is simple. Take advantage of our professional online solution with DocHub!

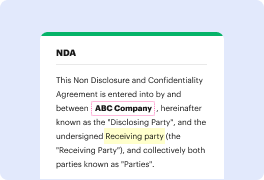

you might be wondering what that nine digit number is with a hyphen in between the first two numbers that is your employer identification number also known as your ein an ein or an employee id number is your federal tax id for your business think of it like a social security number for your business you have a social security number as a person your business also needs a social security number however itamp;#39;s not called a social security number when it comes to a business itamp;#39;s called an ein eins typically look like this sometimes an ein is also referred to as a tin which stands for taxpayer identification number sometimes it will be referred to as an fein which stands for federal employer identification number and sometimes it even stands for ftin which is federal tax identification number think of an ein as a social security number for your business every business needs one every person needs a social security number every business needs a social security number so if you