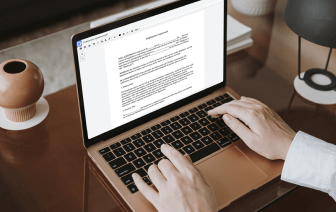

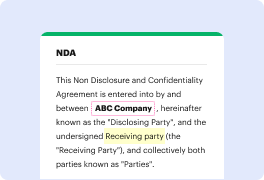

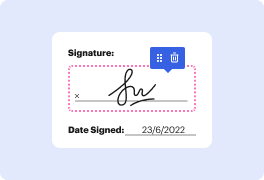

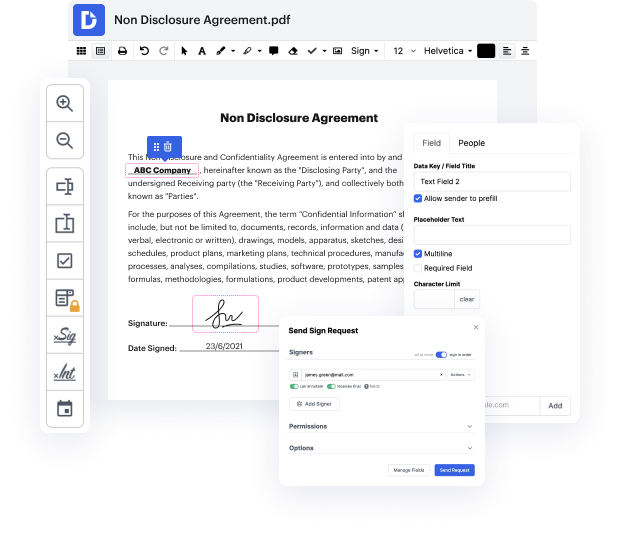

With DocHub, you can easily revise FATCA in VIA from any place. Enjoy capabilities like drag and drop fields, editable text, images, and comments. You can collect electronic signatures securely, add an additional level of defense with an Encrypted Folder, and collaborate with teammates in real-time through your DocHub account. Make changes to your VIA files online without downloading, scanning, printing or mailing anything.

You can find your edited record in the Documents folder of your account. Create, send, print, or turn your document into a reusable template. Considering the variety of robust features, it’s easy to enjoy trouble-free document editing and management with DocHub.

okay hi this is Anthony parent of Iris medic and thank you for joining me today you know we have this curious situation where we have a lot of Americans overseas who the IRS doesnamp;#39;t believe is in tax compliance and uh the foreign account tax compliance that gave them some tools by which to compel Americans overseas and those in America with accounts overseas to bring them home to the American tax system even if theyamp;#39;re not American itamp;#39;s okay um and doing so the the IRS is sort of uh trying to to round them up to round them up to uh get all these uh Banks to do their bidding and to uh make sure that this uh noose uh gets tightened and thereamp;#39;s less wiggle room to escape to to um help the IRS in its Mission we have a curious notice that came out and itamp;#39;s IRS notice 2002 -11 and this is a session this is essentially what itamp;#39;s trying to do itamp;#39;s um itamp;#39;s encouraging U.S residents and the jurisdictions to provide their their taxpa