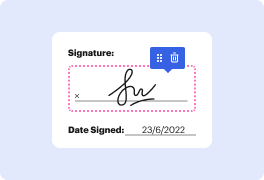

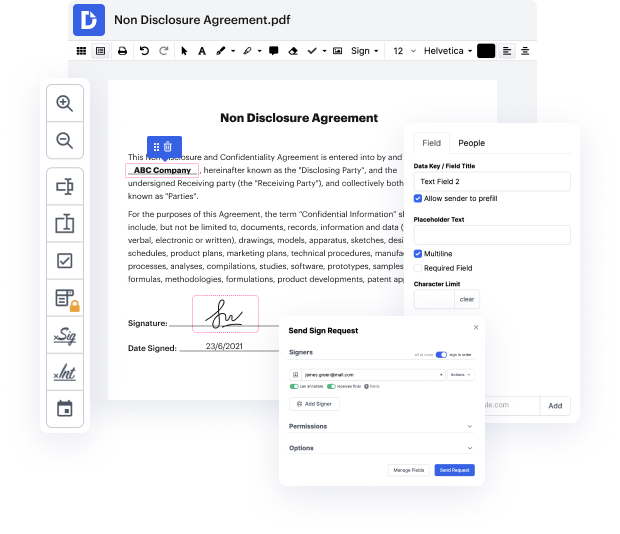

Do you want to avoid the challenges of editing Money Loan Contract online? You don’t have to bother about installing untrustworthy solutions or compromising your documents ever again. With DocHub, you can restore title in Money Loan Contract without having to spend hours on it. And that’s not all; our easy-to-use platform also gives you powerful data collection tools for collecting signatures, information, and payments through fillable forms. You can build teams using our collaboration features and effectively interact with multiple people on documents. On top of that, DocHub keeps your information safe and in compliance with industry-leading security requirements.

DocHub enables you to access its features regardless of your device. You can use it from your laptop, mobile device, or tablet and modify Money Loan Contract effortlessly. Start working smarter today with DocHub!

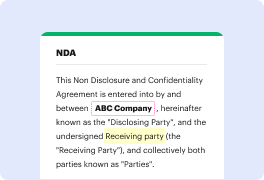

Michael Wasslick, a lawyer at Ricardo and Wassup in Florida, discusses debt validation letters, their usage, and how they protect consumers' rights. He explains what a debt validation letter is, how it can be used effectively, and the necessary components it should include. Wasslick emphasizes the importance of sending these letters and provides guidance on the appropriate timing for doing so. He encourages viewers to subscribe to the channel for more information on debt collection and credit scores and invites them to share the video with others who may benefit from it. Additionally, he welcomes questions that may not be addressed in the video.