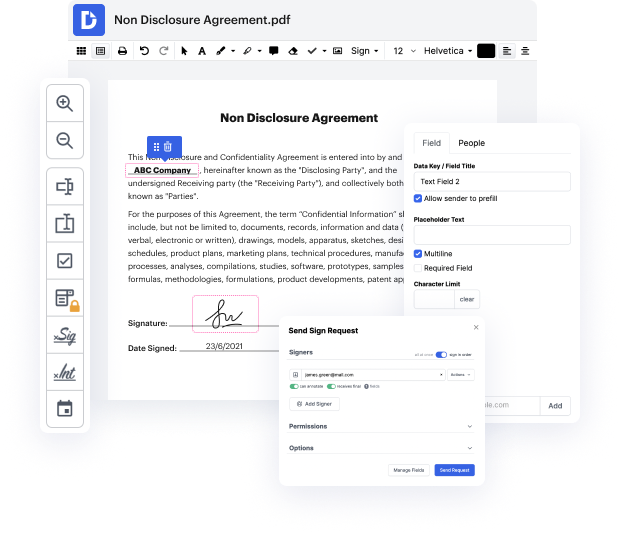

Time is a crucial resource that every company treasures and tries to transform in a gain. When selecting document management software program, be aware of a clutterless and user-friendly interface that empowers customers. DocHub provides cutting-edge instruments to enhance your document managing and transforms your PDF file editing into a matter of a single click. Replace Option Choice in the Self-Evaluation with DocHub to save a lot of time and improve your efficiency.

Make PDF file editing an simple and intuitive process that saves you plenty of precious time. Effortlessly adjust your files and send them for signing without switching to third-party options. Concentrate on relevant duties and increase your document managing with DocHub starting today.

(chill music) - We all make mistakes from time to time. But if youve made mistakes on your self-assessment tax return, can you change it? The good news is that, if you have just spotted a mistake, then dont panic. There are ways to amend it. (chill music) The deadline for filing the self-assessment tax return is the 31st of January each year. If you have already filed your return but have noticed that you have made a mistake, then do not panic as you can amend it. (chill music) If you have submitted your tax return, but you want to make changes then it is possible to amend if you do it within 12 months of the filing deadline. For example, if you have submitted your 2018/19 return online by the deadline of 31st of January of 2020, then you will have until the 31st of January 2021 to amend it. (chill music) If it is later than the 12 months after the due date, then you will no longer be able to file an amended tax-return. If this is the case, then you will have to write to HMRC to tell