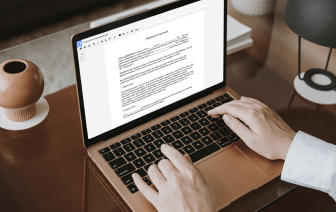

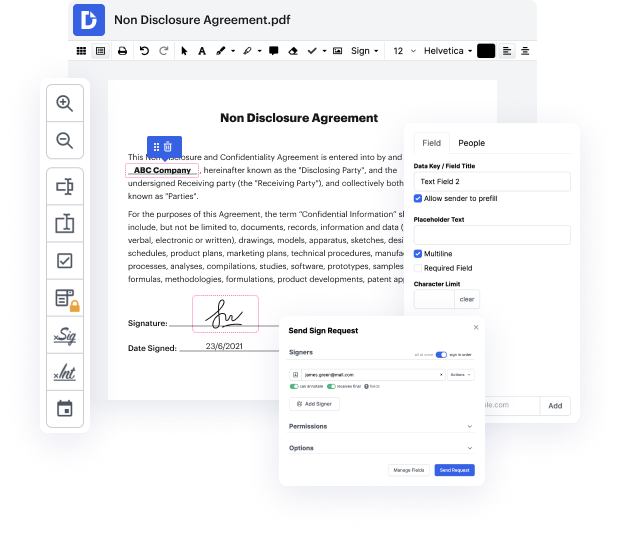

Time is a vital resource that every organization treasures and tries to convert in a gain. When selecting document management software, focus on a clutterless and user-friendly interface that empowers customers. DocHub provides cutting-edge instruments to improve your file management and transforms your PDF editing into a matter of a single click. Replace Mark to the Refund Request Form with DocHub to save a lot of time as well as increase your productivity.

Make PDF editing an easy and intuitive process that saves you plenty of valuable time. Effortlessly change your files and give them for signing without looking at third-party alternatives. Concentrate on relevant duties and increase your file management with DocHub today.

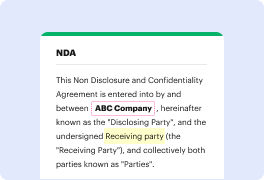

is it a wonderful day what are you so excited about oh well lets see Ive got a great family a successful business all is well in the world okay oh yeah and I just filed our sales tax return electronically you did what oh yeah its all been taken care of I probably returns with a mere click of a button and I made the electronic payment too its all been taken care of whats the matter the return has already been filed I sent it out last week oh no I got it control-z Ill just always cancel it online no you just cant undo it will have to file an amended return to cancel the one you just sent well why cant we cancel the one that you sent will cancel the duplicate return and request a refund well how do we do that who are you and what are you doing in our house Im an employee in the Department of Revenues sans tax refund section and Im here to help you with your refund first you must complete the application an application for sales use tax refund or credit must be submitted to the