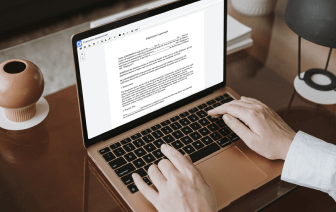

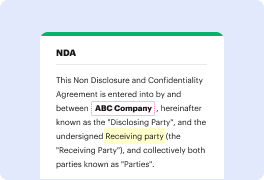

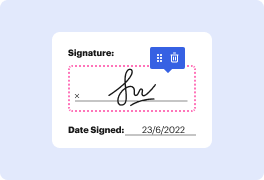

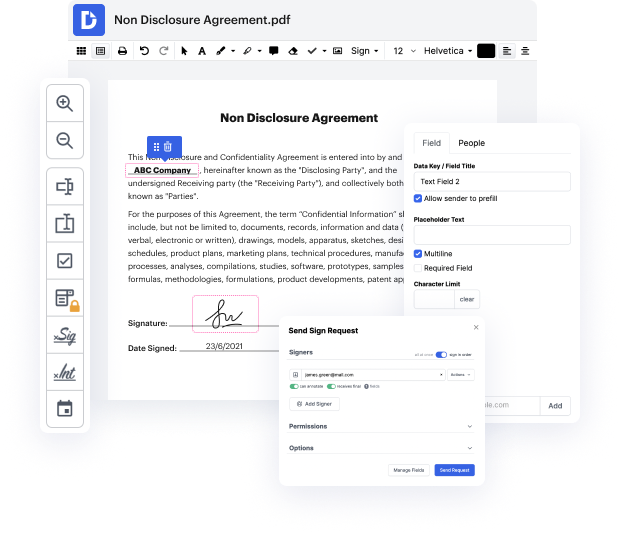

Handling and executing papers can be tiresome, but it doesn’t have to be. Whether you need assistance everyday or only occasionally, DocHub is here to supply your document-centered projects with an extra productivity boost. Edit, comment, fill in, sign, and collaborate on your Retirement Plan rapidly and effortlessly. You can adjust text and pictures, build forms from scratch or pre-made web templates, and add eSignatures. Due to our high quality safety measures, all your data remains safe and encrypted.

DocHub provides a comprehensive set of capabilities to streamline your paper workflows. You can use our solution on multiple devices to access your documents anywhere and anytime. Improve your editing experience and save hours of handiwork with DocHub. Try it for free today!

hi welcome back to my channel in this video I will explain the ending of the retirement plan so lets begin in the retirement plan when Ashley and her young daughter Sarah get caught up in a criminal Enterprise that puts their lives at risk she turns to the only person who can help her estranged father Matt Nicholas Cage currently living the life of a retired Beach bomb in the Cayman Islands their reunion is fleeting as they are soon Tracked Down on the island by Crime Boss Donnie and his Lieutenant Bobo as Ashley Sarah and Matt become entangled in an increasingly dangerous web Ashley quickly learns her father had a secret past that she knew nothing about and that there is more to her father than meets the eye here is everything you need to know about the ending just to let you know this video will contain spoilers at the beginning of the retirement plan we see that Jimmy comes out of a building and he asks his wife Ashley to immediately start the car and escape from there Jimmy had st