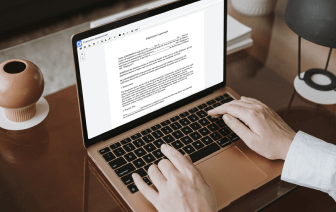

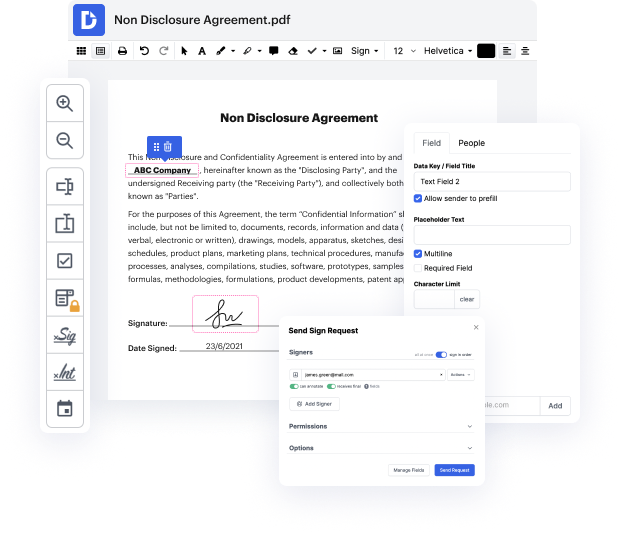

Time is a crucial resource that every company treasures and tries to transform into a advantage. When selecting document management application, take note of a clutterless and user-friendly interface that empowers consumers. DocHub provides cutting-edge tools to maximize your document management and transforms your PDF file editing into a matter of one click. Replace Cross from the Satisfaction Of Mortgage with DocHub to save a ton of time and increase your efficiency.

Make PDF file editing an easy and intuitive process that helps save you plenty of precious time. Effortlessly change your documents and deliver them for signing without having switching to third-party options. Concentrate on relevant duties and improve your document management with DocHub today.

in the past ive spoken about the fact that a fact pattern will repeat itself across different cases and i have two different real estate transactions where selling property and one is a reverse more one property has a reverse mortgage and the reverse mortgage should have and in fact did um how do i put this uh take over all of the other uh existing loans there had been several so in this particular real estate transaction we have six pages of mortgages um citibank and bank of america all the way through to the reverse mortgage what am i getting at well when the mortgages were consolidated those prior mortgages maybe i should have started there say you have an existing 50 000 mortgage and you go to a bank because the rate is lower and you want to borrow you want to get a new rate you want to borrow 100 000 the first 50 000 that was in existence whatever the balance is that gets thrown into the total mortgage of a hundred so youll only receive new money maybe fifty two thousand sixty a