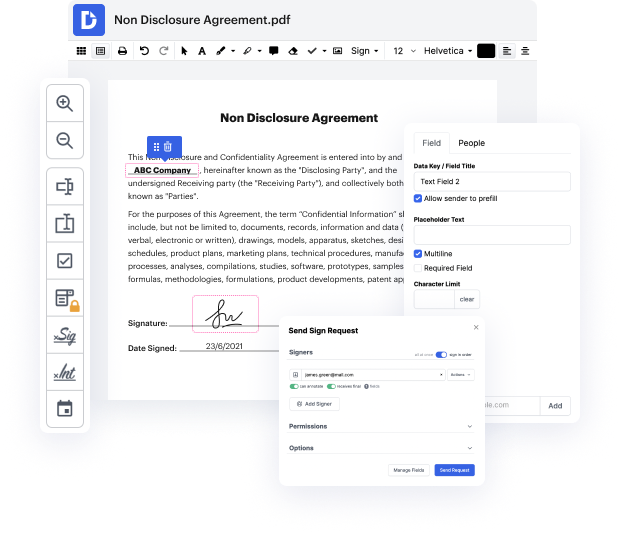

Time is a vital resource that each enterprise treasures and tries to turn in a gain. When choosing document management application, take note of a clutterless and user-friendly interface that empowers consumers. DocHub gives cutting-edge features to optimize your file administration and transforms your PDF editing into a matter of one click. Replace Comments into the Demand For Extension Of Payment Date with DocHub in order to save a lot of time as well as boost your productivity.

Make PDF editing an simple and easy intuitive process that helps save you plenty of precious time. Effortlessly adjust your documents and deliver them for signing without the need of turning to third-party software. Give attention to relevant duties and boost your file administration with DocHub starting today.

im brad from WP sites net this code enables you to replace the comment date with text when the comments are older than this specific date so lets take a look at the the demo site ill get that fired up and heres some comments that are more than a year old and whats displaying here is a custom message and you can change this to anything you like so all comments that are more than a year old or more than this older than a specific date display a custom message so we go back to it a new post with some new comments on it and we just get the standard date that displays below the comment authors name so its as simple as that its highly flexible you can customize and change the date very very easily and change the text as well so Ive just recently published that the code theres two code snippets on WP sites dotnet all the code installation and modification for the code supported for members of WP sites thanks for watching see you next time cheers