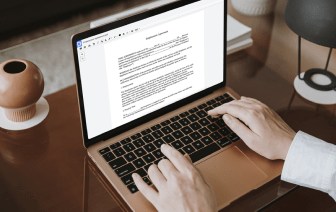

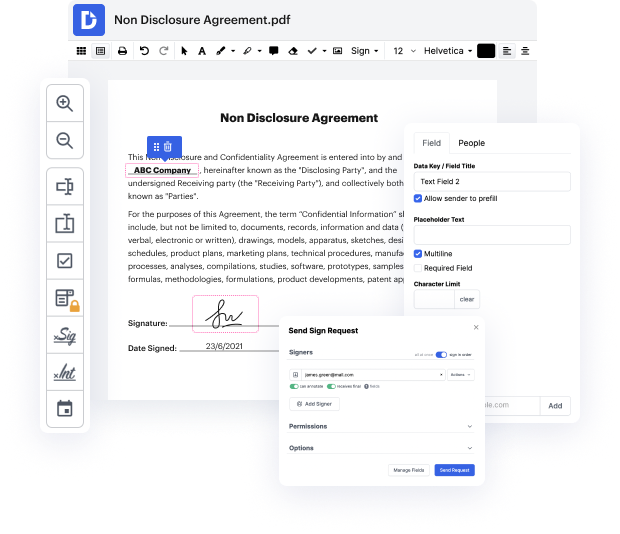

Time is an important resource that every business treasures and attempts to transform in a advantage. In choosing document management application, pay attention to a clutterless and user-friendly interface that empowers customers. DocHub gives cutting-edge tools to maximize your file administration and transforms your PDF editing into a matter of a single click. Replace Calculations from the Exchange Of Shares Agreement with DocHub to save a ton of time and improve your productiveness.

Make PDF editing an simple and easy intuitive operation that helps save you plenty of valuable time. Easily modify your files and send out them for signing without the need of turning to third-party alternatives. Focus on pertinent tasks and boost your file administration with DocHub right now.

one of the decisions that managers may face almost certainly will face is replacing an old machine with a new machine now as we take a look at this what we really want to do is we want to whittle away the irrelevant costs and focused only on the differential costs those things that differ between alternatives lets take a look at what we know about the old machine we bought it originally for $90,000 so its on the balance sheet with a historical cost of 90,000 Alex and weve been depreciating this asset accumulated depreciation 33 grand so we have a Book value here of 57 thousand dollars now if we wanted to sell this machine we could sell it right now for $14,000 if we wait five years and sell it after using it for another five years we probably will only be able to sell it for $2,000 were depreciating the asset at a rate of $11,000 per year which tells you that weve been depreciating it for three years the depreciation thats accumulated is 33,000 so thats three years and we incur