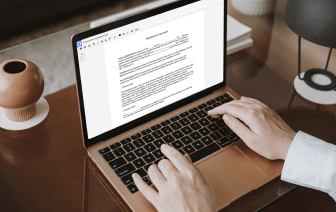

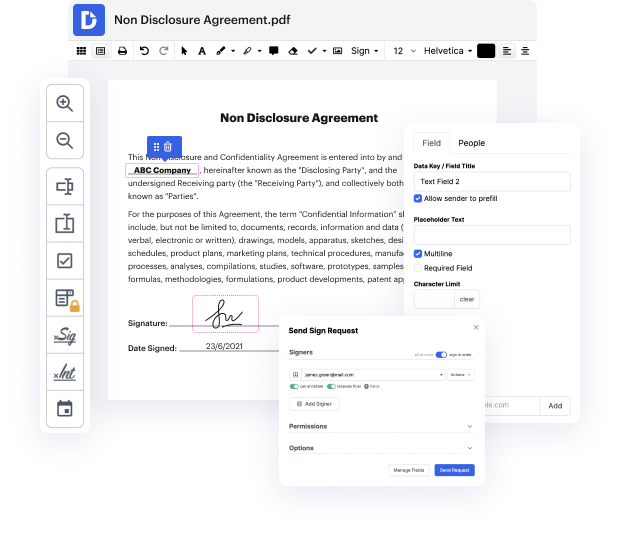

Time is a crucial resource that each enterprise treasures and attempts to turn into a advantage. In choosing document management software program, take note of a clutterless and user-friendly interface that empowers customers. DocHub gives cutting-edge features to improve your document administration and transforms your PDF editing into a matter of one click. Replace Amount Field in the Partnership Amendment with DocHub in order to save a lot of time and increase your efficiency.

Make PDF editing an simple and intuitive operation that saves you a lot of valuable time. Easily modify your files and give them for signing without looking at third-party options. Focus on relevant tasks and enhance your document administration with DocHub starting today.

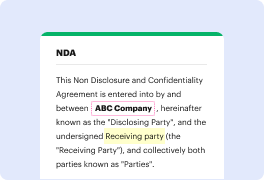

welcome to gov grants technology for service providers this video will help you gain a better understanding on how to adjust your budget categories for funding change amendment you can click on the pause button at any time rewind or fast forward the video lets begin learning objectives at the end of this gov grants tutorial video on funding change amendment you will be able to pick up a pending task and begin working on the funding change amendment amend respective budget categories and ensure that the amounts match the funding change increase or decrease submit to the region of po changes and await an email notification indicating that the funding change is approved heres an email notification that you will receive indicating that you need to log into your govgrants account and pick up the funding change amendment heres the amendment id number that you will look for and heres the grant name so now that youve logged into gov grants to begin working on the tasks click on the grants