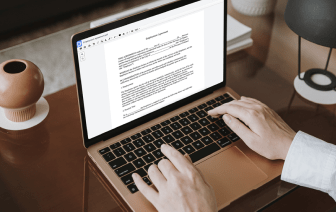

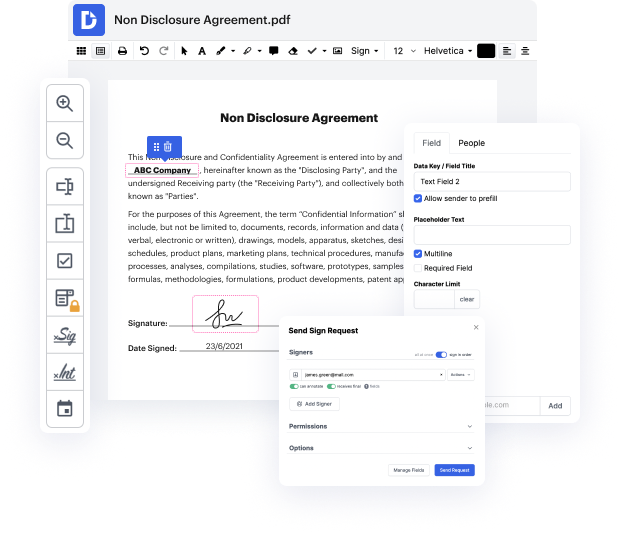

Time is an important resource that each enterprise treasures and tries to turn into a gain. When picking document management software, pay attention to a clutterless and user-friendly interface that empowers customers. DocHub provides cutting-edge instruments to enhance your file management and transforms your PDF file editing into a matter of one click. Replace Alternative Choice into the Partnership Amendment with DocHub to save a ton of time as well as improve your efficiency.

Make PDF file editing an simple and easy intuitive process that helps save you a lot of valuable time. Quickly change your files and send them for signing without switching to third-party software. Concentrate on pertinent tasks and increase your file management with DocHub starting today.

[Music] hello and welcome to this video from ey which deals with some of the key accounting challenges posed by eyeball reform my name is tony clifford and im joined by jane herwith and david bradbury hi tony hi there tony now weve issued a number of publications and videos on the development of the isbs amendments to address the accounting implications of the replacement survivals such as libel with risk-free rates or rfrs such as sonya or sofa this video accompanies the by publication applying ifrs eyeball reform which was published at the end of september and well be talking through the worked examples that are included in that publication and explaining the key points arising the amendments to ifrs in response to eyeball reform have been dealt by the iasb in two phases the first phase was completed in september 2019 and with the publication of amendments to ifrs that dealt with the uncertainty arising during the period before a benchmark interest rate is replaced with an altern