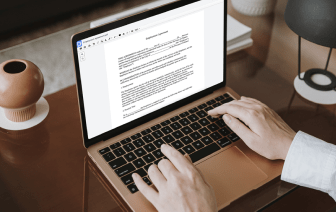

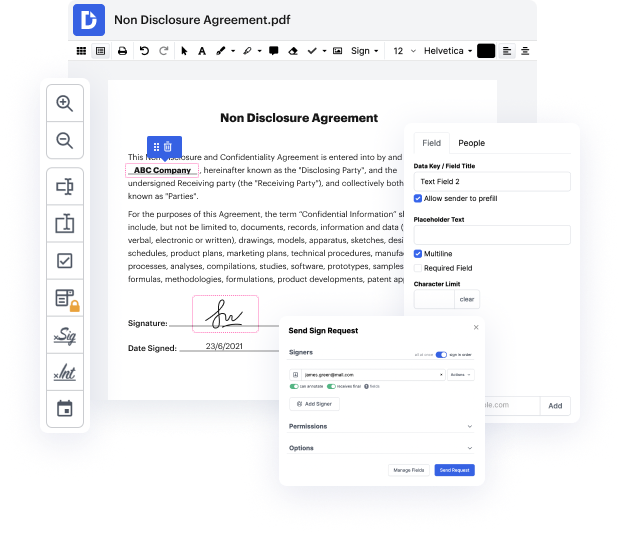

Document generation and approval certainly are a core priority for each company. Whether working with sizeable bulks of files or a particular agreement, you must stay at the top of your productiveness. Getting a ideal online platform that tackles your most typical record generation and approval problems may result in quite a lot of work. Many online platforms provide only a limited set of modifying and eSignature features, some of which might be useful to handle raw formatting. A platform that deals with any formatting and task will be a exceptional option when deciding on application.

Take document management and generation to another level of simplicity and sophistication without opting for an awkward interface or pricey subscription options. DocHub provides you with instruments and features to deal effectively with all document types, including raw, and execute tasks of any difficulty. Change, manage, and produce reusable fillable forms without effort. Get complete freedom and flexibility to replace account in raw anytime and securely store all your complete files in your profile or one of many possible integrated cloud storage space platforms.

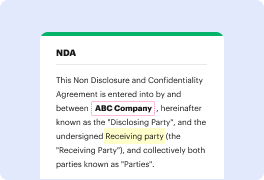

DocHub provides loss-free editing, signature collection, and raw management on the expert level. You don’t need to go through tiresome tutorials and invest hours and hours finding out the software. Make top-tier safe document editing an ordinary process for the day-to-day workflows.

okay guys uh this video is quite a quick video um what were gonna be covering are these spreads in the markets and essentially the raw spread account versus the standard accounts uh now spreads move in three cycles uh they do move in four but for arguments sake were going to say three so what we have is um 955 pre-market close uh spreads will start to expand because of low liquidity um then five minutes after ten is when brokers reopen youre actually allowed to trade uh spreads will sl will open and theyll be quite large on a standard account you will see huge spreads depending on the currency youre trading if its not a major pair and its exotic it will be crazy we also have the uh 1030 which is um essentially like pre-market for asia spreads will as soon as it hits half past spreads will dip like 0.1.2 pips theyll drop down and then as soon as we hit 11 oclock which is sydney australia time you will see the spreads drastically drop um but its obviously the cost and the spr