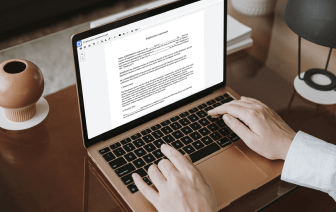

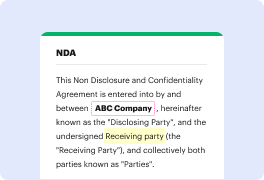

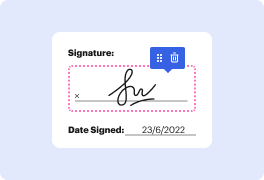

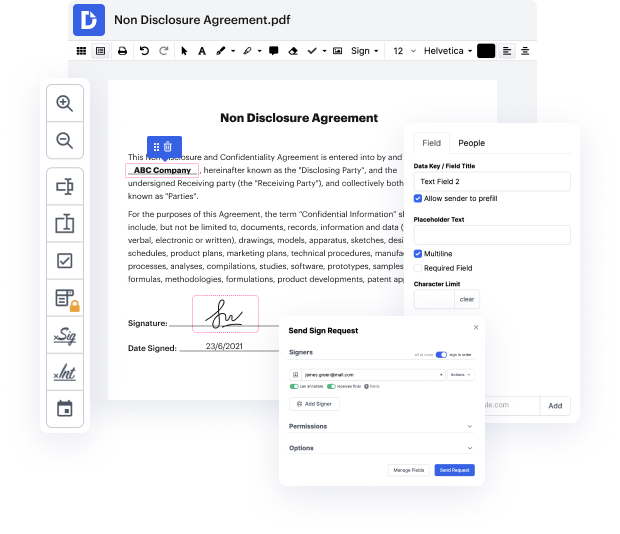

Time is a vital resource that each organization treasures and attempts to change into a reward. When selecting document management application, be aware of a clutterless and user-friendly interface that empowers customers. DocHub offers cutting-edge features to enhance your document management and transforms your PDF file editing into a matter of one click. Remove Surname Field to the Interest Transfer Agreement with DocHub to save a ton of time as well as boost your productivity.

Make PDF file editing an simple and easy intuitive process that helps save you a lot of precious time. Effortlessly adjust your documents and send them for signing without the need of switching to third-party alternatives. Give attention to pertinent duties and enhance your document management with DocHub today.

[Music] hi Im Annie Fitzsimmons Im your Washington Realtors Legal Hotline lawyer todays video is another in our continuing series entitled real estate fundamentals you should know this is a question that comes up quite a bit believe it or not we have a married couple but only one member of the marriage is going to be on title to the property why it doesnt really matter why maybe its because of financing maybe its because somebodys out of town maybe its because somebodys getting a divorce and and the divorce isnt yet final but the person that the buyer wants to go ahead and buy even before the divorce is final any number of reasons we dont care what it is the question is does that fact have an impact on the transaction and the answer is absolutely yes the impact is that the title company assuming the buyer has to get financing the title company will not insure title for the buyers lender unless that spouse whose name will not appear on title signs a quitclaim deed releasing t