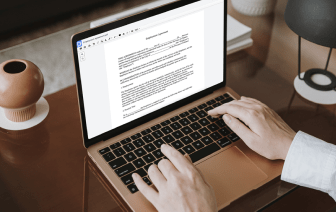

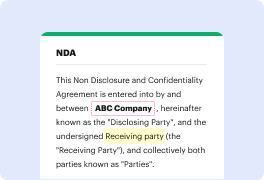

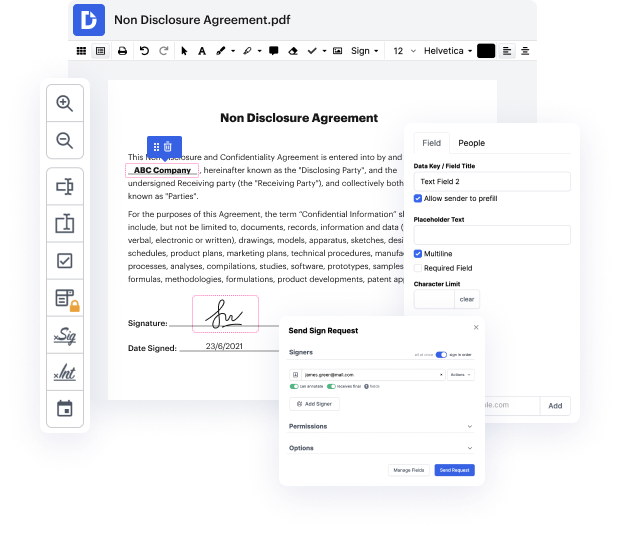

Time is a vital resource that each organization treasures and attempts to turn into a reward. When picking document management application, be aware of a clutterless and user-friendly interface that empowers users. DocHub gives cutting-edge features to enhance your document administration and transforms your PDF file editing into a matter of one click. Remove Number Fields in the Mortgage Agreement with DocHub to save a ton of time and enhance your productivity.

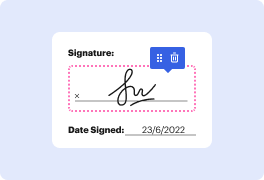

Make PDF file editing an simple and intuitive operation that helps save you a lot of precious time. Easily alter your files and deliver them for signing without having adopting third-party alternatives. Give attention to relevant tasks and increase your document administration with DocHub right now.

hi Bradley cheer your mortgage got for life I wanted to just take the equipment in here gonna make it real short and sweet and answer some questions Ive got some notes here that Im gonna just Im gonna go over Im gonna hit it quick you have questions afterwards feel free to email me or call me find me your mortgage guy for life calm why dont you mortgage mor TG a GE guy GUI Im sorry GUI for fo r L IFE calm if youre if you found me because youre googling or searching YouTube for a video about how to remove yourself or your ex spouse from the home whether it be the mortgage or title after the divorce thats what Im gonna go over its gonna be quick and easy first off you can talk about removing removing you or the Lord or your ex spouse from the home loan afterwards theres theres really no way to remove someone from the home loan with that refinancing so what what I tell people is you know you if youre on that both of your on the current home loan youre not gonna be able to c