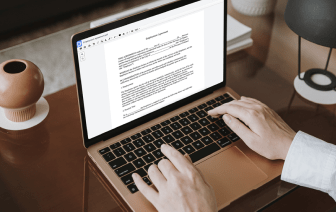

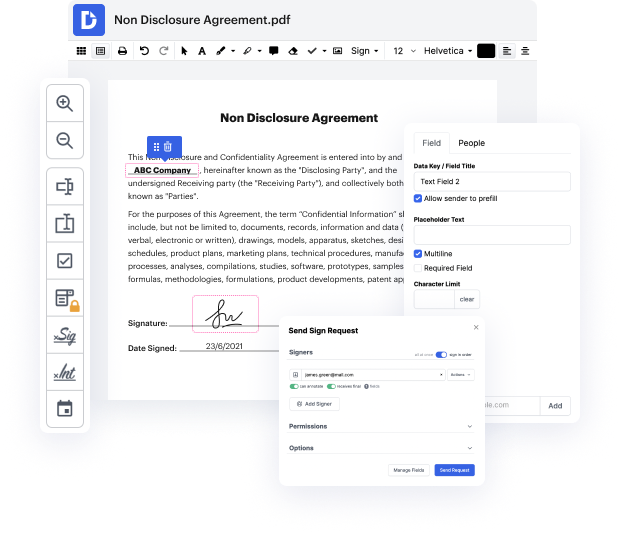

Time is a vital resource that every company treasures and attempts to convert into a gain. When picking document management software program, take note of a clutterless and user-friendly interface that empowers customers. DocHub offers cutting-edge instruments to optimize your document management and transforms your PDF file editing into a matter of a single click. Remove Line from the Letter Approving Credit Application with DocHub to save a ton of efforts and increase your productivity.

Make PDF file editing an simple and intuitive process that helps save you a lot of precious time. Quickly adjust your documents and send them for signing without having adopting third-party options. Focus on relevant tasks and improve your document management with DocHub today.

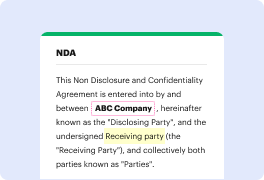

hi Im Ian like that the consumer insider Im a consumer protection attorney from Southfield Michigan and I love my job for 25 years Ive been representing consumers and disputes with credit reporting agencies debt collectors and car dealers and every week were bringing a new podcast and show you how it is that these businesses use documents and business practices to cheat and bully consumers and today I want to talk to you about something that not a lot of people know about which is credit denial letters these letters come to you pretty regularly after youve applied for credit and not a lot of people know what they are or what informations in them so todays video is going to be targeted at giving you information about what these notices are what theyre supposed to do why theyre being sent and what kinds of information is in them that will help you understand your credit situation and what you can do to improve your credit and whether or not you maybe have been cheated on somethin