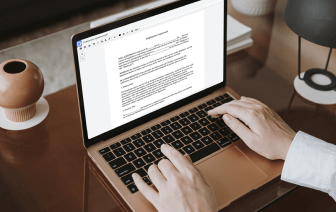

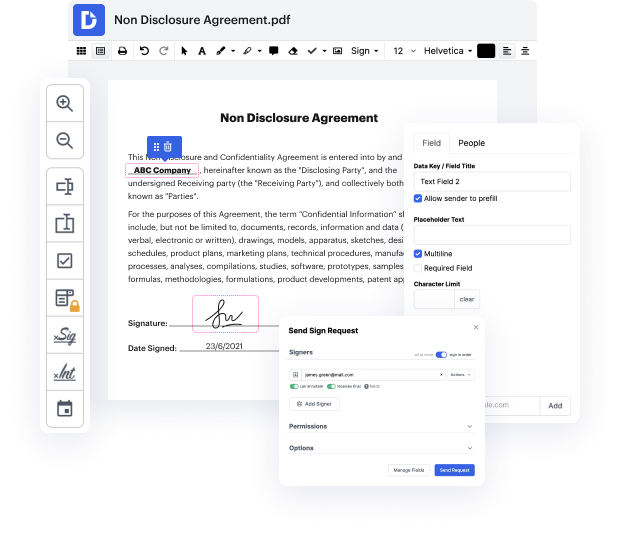

Time is a vital resource that every enterprise treasures and tries to turn into a advantage. In choosing document management software program, take note of a clutterless and user-friendly interface that empowers users. DocHub gives cutting-edge instruments to optimize your document administration and transforms your PDF file editing into a matter of a single click. Remove Data to the Living Trust with DocHub to save a ton of time and enhance your productivity.

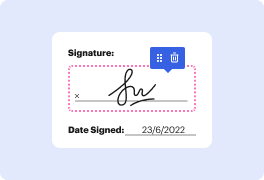

Make PDF file editing an simple and easy intuitive process that saves you a lot of precious time. Easily adjust your documents and send them for signing without the need of turning to third-party alternatives. Concentrate on relevant tasks and boost your document administration with DocHub right now.

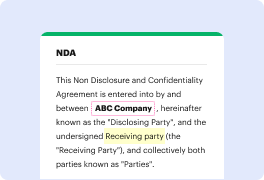

hey guys Paul Rabelais here here to address the sometimes confusing topic too many of can an irrevocable trust be changed or amended scare some people sometimes but it may not need to all trusts are either can either be classified as revocable trusts or irrevocable trusts in by far the most popular form of the revocable trust with an R is this avoid probate revocable living trusts where you stay in and control of everything that you have but when you pass away nothings frozen the family doesnt have to go through attorney in court involvement - to gain access to assets so theres a lot written and said and videoed about revocable living trusts and avoided voiding probate thats not the topic of this video however some trusts are whats called irrevocable trusts and theyre done for maybe several different reasons sometimes a revocable trust these days are done to avoid taxes sometimes theyre done to avoid losing assets if you get sued sometimes people create your revocable trust beca