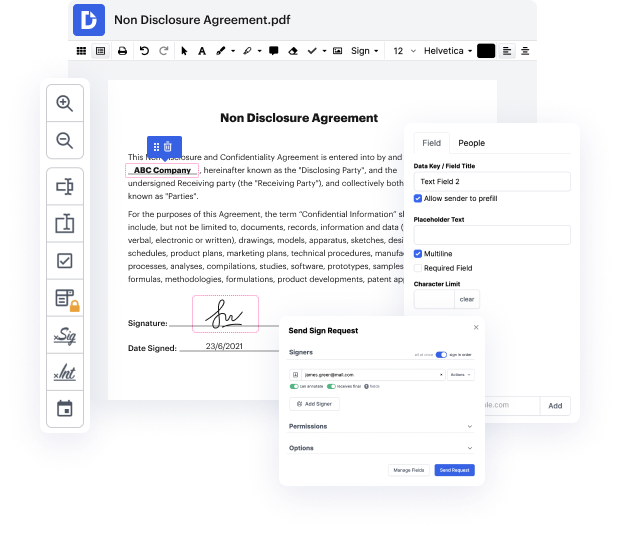

With DocHub's easy-to-use drag-and-drop document editor, you may effortlessly remove data in Gift Affidavit and save time and effort without having to download any software. Your Gift Affidavit can be ready for use after several simple actions. Modifying paperwork has never been easier with DocHub.

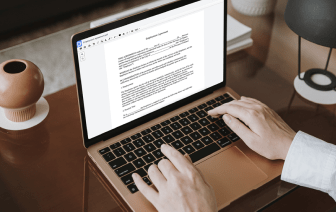

Users laud DocHub for its outstanding functions and user-friendliness. You do your editing online, therefore, you only need an internet-enabled device. DocHub guarantees a smooth and easy editing experience on desktop and mobile devices so you can focus on your Gift Affidavit at any time and anywhere. You get not only a standard PDF editor but an end-to-end document management platform that enables you to operate a completely electronic workflow.

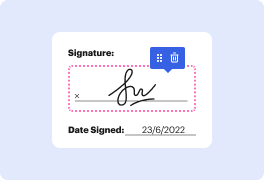

You can get your document in the Documents folder of your DocHub profile after you complete editing it. Additionally, you can create and reuse ready-made templates to save time when making changes in the future. Rest assured that we keep your documents and data secure and safe.

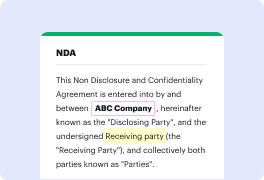

Hello. This video is to help you with filling in our application form AP1, which is one of the most common form you need to use when youre dealing with us. Its used for a lot of different types of application to change the register. Im not going to try and cover all of these, only how to complete the form generally. Depending on the type application that youre going to make, you might need to refer to some of the other guidance that we have on our website. So this video is only going to help you with filling in the routine parts of the form. If you need help on what information to put in, you will need to seek legal advice. If you decide to employ a solicitor they may be able to lodge your application electronically. This is quicker and more secure. You must use this form if you want to make an application to change something on the register and here are some examples: the change of ownership; you might want to add a partners name or you might want to take someones name off or yo