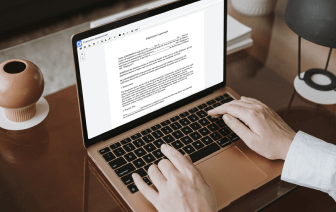

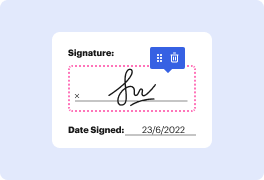

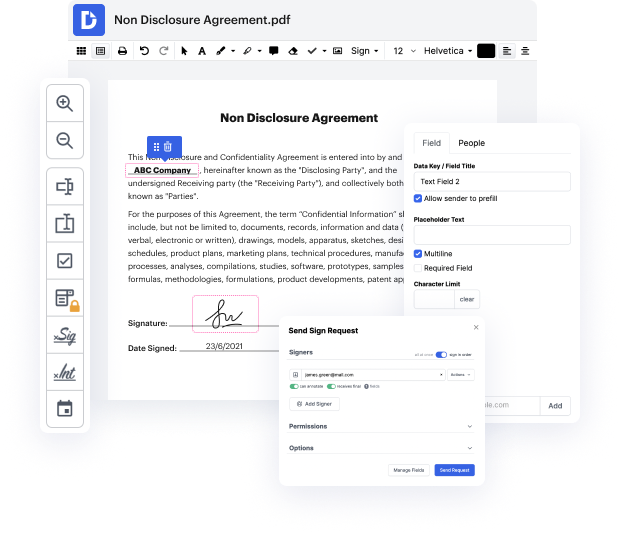

Time is a crucial resource that every business treasures and attempts to convert in a gain. In choosing document management application, pay attention to a clutterless and user-friendly interface that empowers customers. DocHub delivers cutting-edge features to optimize your document management and transforms your PDF editing into a matter of one click. Remove Cross from the Notice Of Default Letter with DocHub in order to save a ton of time and increase your efficiency.

Make PDF editing an simple and intuitive process that saves you a lot of valuable time. Quickly adjust your files and give them for signing without the need of adopting third-party alternatives. Focus on pertinent duties and improve your document management with DocHub right now.

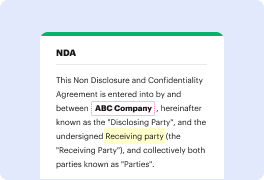

so you have a mortgage and youre facing some hard times youre starting to miss some payments and you get something called a default notice or a notice of default what in the world is that well that typically is a letter sent around maybe 90 days maybe four months after you start missing payments and the letter basically says youre in default you have broke the promise broke the contract and if you dont fix it in 30 days then we are going to accelerate the lung and make it all do right now so instead of having 30 years to pay it boom its all do right now and were going to foreclose thats what I notice a default is so whats a typical default well the classic is were not making our payments so they say you owe $1,500 a month youre three months behind so youre $4,500 behind you now have 30 days to cure or fix the default if you do that great but if you do not do that then youll get a letter called a notice of acceleration well talk about that in the next video but that means y