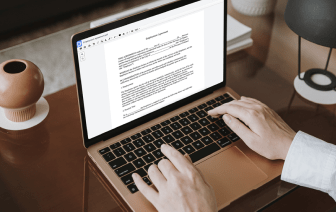

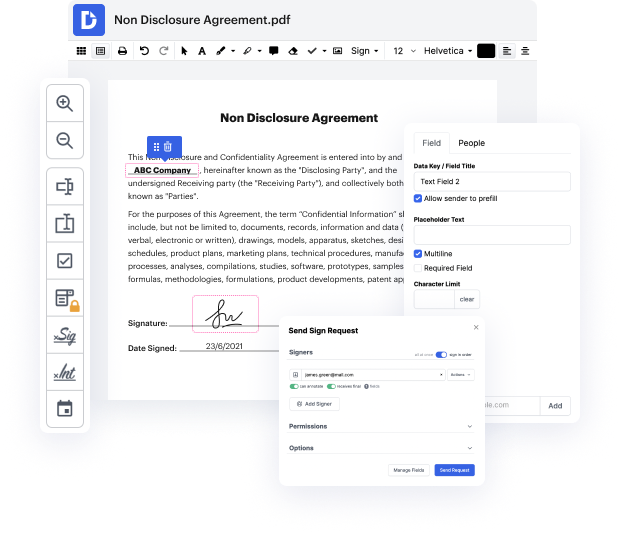

Time is a vital resource that every enterprise treasures and attempts to change in a gain. When picking document management software program, pay attention to a clutterless and user-friendly interface that empowers customers. DocHub delivers cutting-edge features to optimize your document managing and transforms your PDF file editing into a matter of a single click. Remove Conditional Fields into the Interest Rate Lock Agreement with DocHub in order to save a ton of efforts and boost your productiveness.

Make PDF file editing an simple and intuitive operation that helps save you a lot of valuable time. Effortlessly alter your documents and give them for signing without having looking at third-party alternatives. Give attention to relevant duties and enhance your document managing with DocHub today.

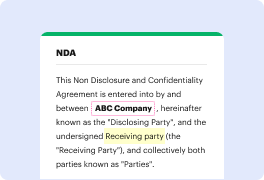

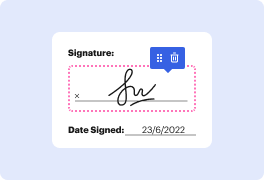

[Music] hi jennifer hernandez what does locking the interest rate actually mean so when you are in transaction with us and you get a property under contract or if youre going to refinance the process is the same so uh lenders ill tell you how legacy does it we we we have 12 to 15 investor entities that we sell our loans to so we have a platform where we look up the rates on that day based on your qualifications your credit debt to income et cetera et cetera and we actually offer you xyz rate for the day lets just say the rate was three percent get very excited so three percent is the 30-year fixed rate for today okay um what that means is that is the rate which our company on that day in that hour or that moment is offering to you so you say yes jennifer we want to do business with you and we want that three percent so i hang up the phone quickly and i go to our secondary marketing department which is a market a department that deals directly with with our funds as we sell them to o