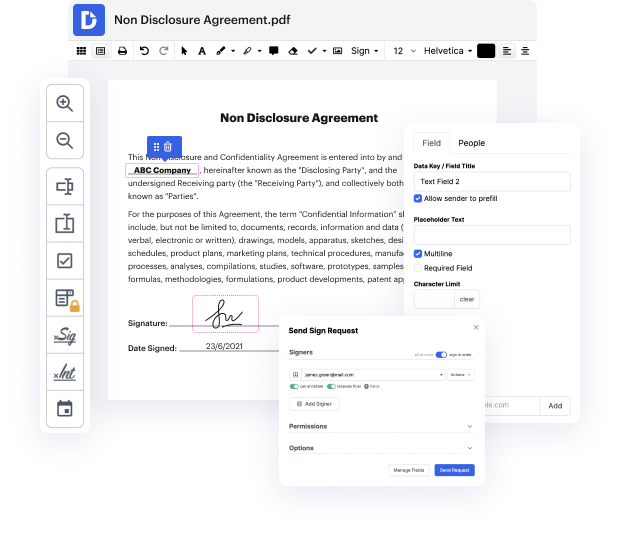

Time is an important resource that each company treasures and attempts to change into a advantage. In choosing document management application, pay attention to a clutterless and user-friendly interface that empowers users. DocHub offers cutting-edge features to enhance your document administration and transforms your PDF editing into a matter of one click. Remove Comments from the Factoring Agreement with DocHub to save a lot of efforts and increase your productiveness.

Make PDF editing an easy and intuitive process that will save you a lot of precious time. Quickly adjust your files and give them for signing without the need of adopting third-party options. Give attention to relevant tasks and improve your document administration with DocHub today.

okay so today youre gonna be talking about factoring companies theres a little confusion about factoring companies and how freight brokers utilize factoring companies in their everyday businesses so what were going to do today is to kind of clear the air on how we use factoring companies when we did use a factoring company and were also gonna give you some questions that you may want to ask the factoring company that you are interested in getting set up with you know ask these questions so that you can get some idea of exactly what youre going into number one lets take a look at what a factoring company is the factoring company is nothing more than a finance company that comes in and says hey we are going to finance your receivable so were gonna finance your invoices Brandon over at Alliance logistics and of course in order for us to provide that financing to your company were gonna charge you an interest rate on the money that we loan to you now thats fair enough just like yo