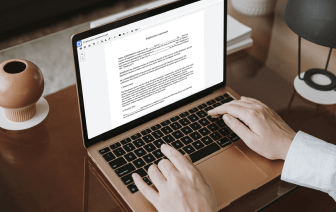

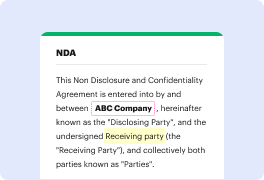

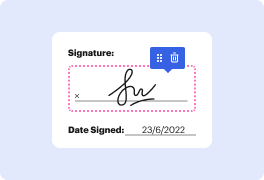

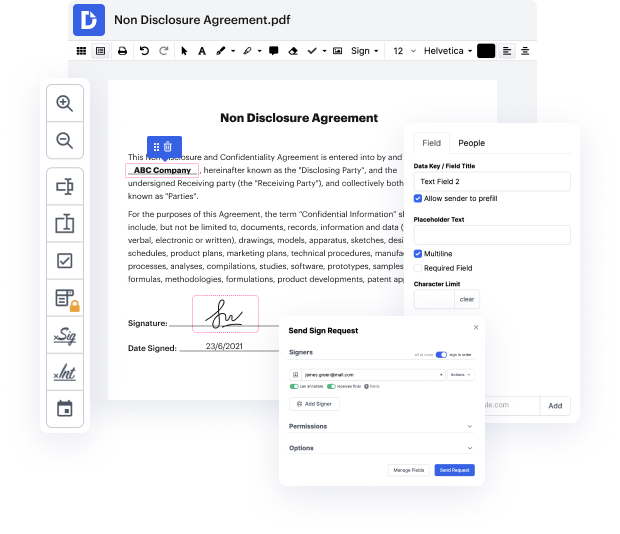

Time is a crucial resource that every organization treasures and attempts to convert into a advantage. When choosing document management software, take note of a clutterless and user-friendly interface that empowers customers. DocHub gives cutting-edge instruments to enhance your file administration and transforms your PDF editing into a matter of a single click. Remove Calculations from the Mortgage Agreement with DocHub to save a lot of time as well as improve your productivity.

Make PDF editing an simple and easy intuitive process that helps save you a lot of valuable time. Easily modify your documents and deliver them for signing without having looking at third-party solutions. Concentrate on pertinent duties and improve your file administration with DocHub right now.

do you have an fha loan or considering purchasing using an fha loan and have questions about the mortgage insurance well in todays video were going to discuss fha mortgage insurance in more detail were going to discuss what pmi actually is were going to talk about how long it lasts were also going to go over a calculation to show you how you can calculate the monthly mortgage insurance as well as the upfront premium when using fha and lastly were going to talk about how to cancel mortgage insurance when you have an fha loan and if you stay tuned to the end of the video im going to tell you why fha loans and the mortgage insurance really arent as bad as most people think they are but before we dive into it i want to take a minute and introduce myself my name is jeb smith im a real estate broker here in southern california and i want to ask a favor if youre going through the video or as youre going through the video if you find it helpful do me a favor and hit that thumbs up a