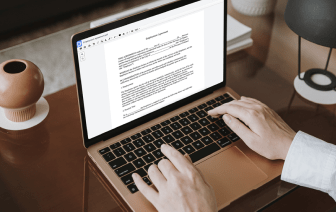

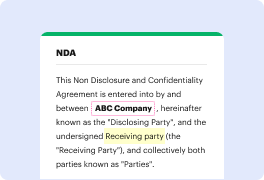

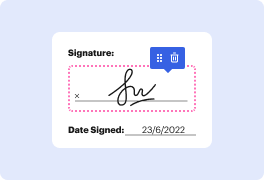

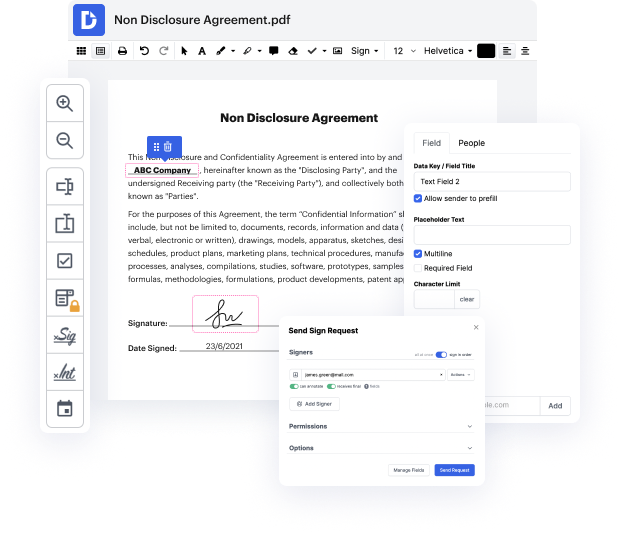

Time is a crucial resource that every organization treasures and tries to turn in a benefit. When selecting document management application, be aware of a clutterless and user-friendly interface that empowers customers. DocHub offers cutting-edge features to optimize your document managing and transforms your PDF file editing into a matter of one click. Remove Amount Field in the Letter Approving Credit Application with DocHub in order to save a ton of time and enhance your productivity.

Make PDF file editing an simple and intuitive operation that will save you plenty of precious time. Quickly alter your documents and deliver them for signing without looking at third-party solutions. Focus on pertinent duties and improve your document managing with DocHub today.

i had not one not two not even three but seven collections on my credit report yes you heard right i said seven collections thats a collection for every day of the week my credit was really bad and i needed to do something fast to get my scores up because i was ready to purchase a house so i got to work and i was able to get all seven of those things removed and i did it all on my own i ended up increasing my credit score by over 100 points and im getting ready to tell you just how i did that and how you can too so dont go nowhere ill be right back money coming money go ive been at it whats up guys this is monique and welcome back to the channel if you are new here thanks so much for stopping by but dont just be a stranger go ahead hit that subscribe button and join the family because here we go everywhere in life together and all we do is win so we are still on our money series where for every single sunday for the rest of the year well be talking money topics from how to save