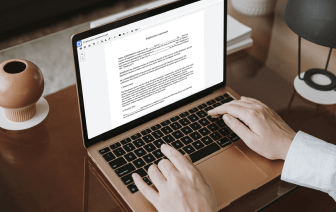

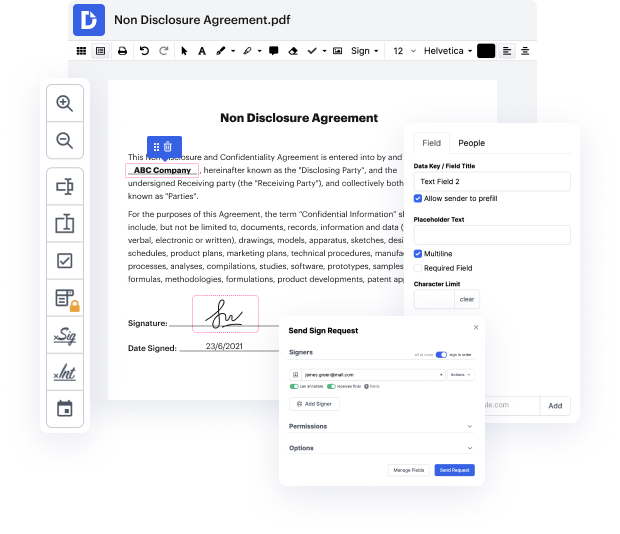

DocHub gives everything you need to easily edit, generate and manage and securely store your IRS Form 1040-ES and any other paperwork online within a single tool. With DocHub, you can stay away from form management's time-consuming and resource-intensive transactions. By eliminating the need for printing and scanning, our ecologically-friendly tool saves you time and minimizes your paper usage.

As soon as you’ve a DocHub account, you can start editing and sharing your IRS Form 1040-ES in no time with no prior experience required. Discover various sophisticated editing features to paste table in IRS Form 1040-ES. Store your edited IRS Form 1040-ES to your account in the cloud, or send it to users via email, dirrect link, or fax. DocHub allows you to turn your form to popular file types without the need of switching between applications.

You can now paste table in IRS Form 1040-ES in your DocHub account anytime and anywhere. Your documents are all stored in one place, where you can edit and handle them quickly and effortlessly online. Give it a try now!

In this tutorial, a self-employed spy, referred to as "Bond, James Bond," explains how to fill out Form 1040-ES for tax filing. He emphasizes that income tax is a pay-as-you-go system. Unlike employees who have federal withholding from their paychecks, self-employed individuals must make quarterly estimated tax payments based on their projected tax liability to avoid underpayment penalties. These payments should cover both income and self-employment taxes and are reported using Form 1040-ES. The video provides step-by-step instructions on completing this form.