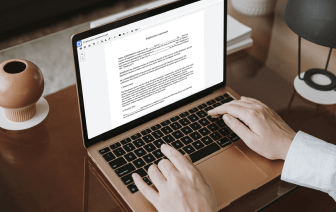

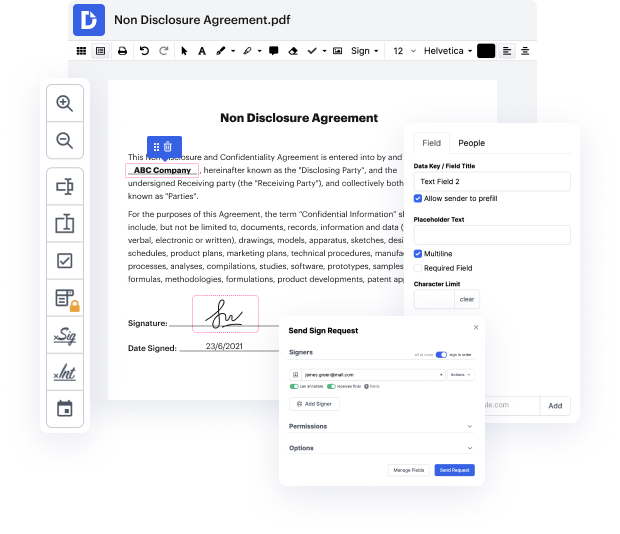

You can’t make document alterations more convenient than editing your tex files on the web. With DocHub, you can access instruments to edit documents in fillable PDF, tex, or other formats: highlight, blackout, or erase document fragments. Add text and images where you need them, rewrite your copy entirely, and more. You can download your edited file to your device or share it by email or direct link. You can also transform your documents into fillable forms and invite others to complete them. DocHub even offers an eSignature that allows you to certify and deliver paperwork for signing with just a couple of clicks.

Your records are securely kept in our DocHub cloud, so you can access them at any time from your desktop computer, laptop, mobile, or tablet. If you prefer to apply your mobile phone for file editing, you can easily do so with DocHub’s application for iOS or Android.

good afternoon this is sean golding with goldie and golding here to discuss the basics of what is fatca what is the foreign account tax compliance act why do you care and how do you comply right like a fatca foreign account tax compliance act uh for u.s person this presentation is focused toward uh individuals uh u.s entities trusted in states that have to report not foreign financial institutions that have their own requirement from a tax perspective fact it came into effect in 2011 on the tax return whereas us persons have to include form 8938 if they meet the threshold requirements for reporting itamp;#39;s used to report specified foreign financial assets itamp;#39;s different than the f bar the f bar is another acronym thrown around on all foreign bank and financial account reporting the fbar is covered under title 31 which is money in finance not 26 which is the internal revenue code an important aspect of that is that when youamp;#39;re filing the uh the f bar youamp;#39;re