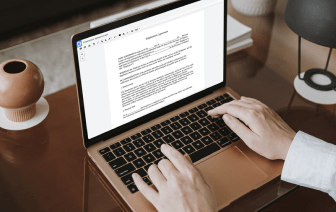

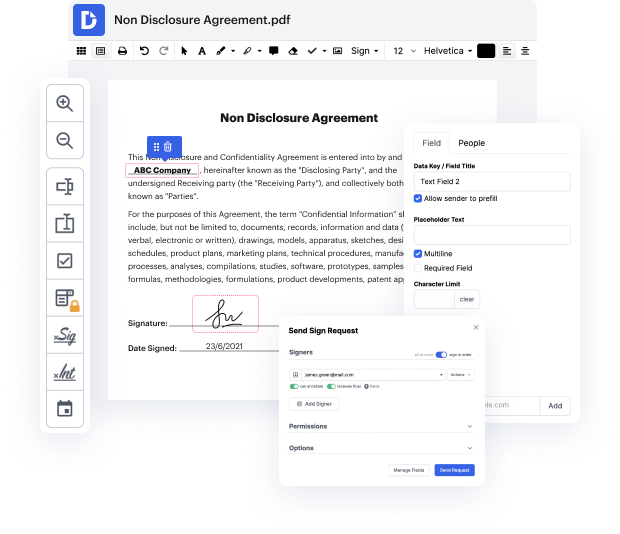

Having full power over your files at any time is crucial to ease your everyday duties and improve your productivity. Accomplish any goal with DocHub tools for papers management and convenient PDF editing. Access, adjust and save and incorporate your workflows along with other safe cloud storage services.

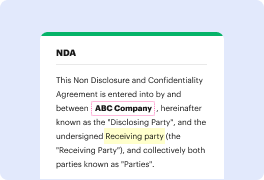

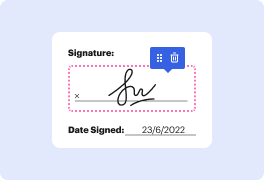

DocHub offers you lossless editing, the chance to use any format, and securely eSign papers without the need of searching for a third-party eSignature software. Maximum benefit of the document managing solutions in one place. Consider all DocHub functions today with your free of charge account.

In this video tutorial, the speaker addresses the topic of seller finance contracts and aims to demystify the process for viewers. By the end, viewers will understand the essential paperwork needed for seller financing. The speaker offers a seller finance contract used successfully by himself and his students and encourages viewers to stay until the end for this resource. New viewers are welcomed, and the speaker emphasizes the importance of subscribing to the channel for those serious about real estate investing, particularly in creative financing, which he has extensively discussed based on his own experience in real estate over the past 15 years.