People often need to modify FATCA in CWK when working with forms. Unfortunately, few programs offer the features you need to accomplish this task. To do something like this normally involves switching between multiple software applications, which take time and effort. Luckily, there is a solution that suits almost any job: DocHub.

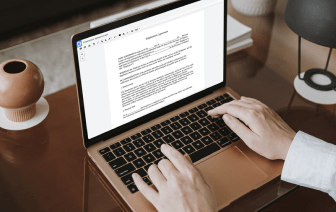

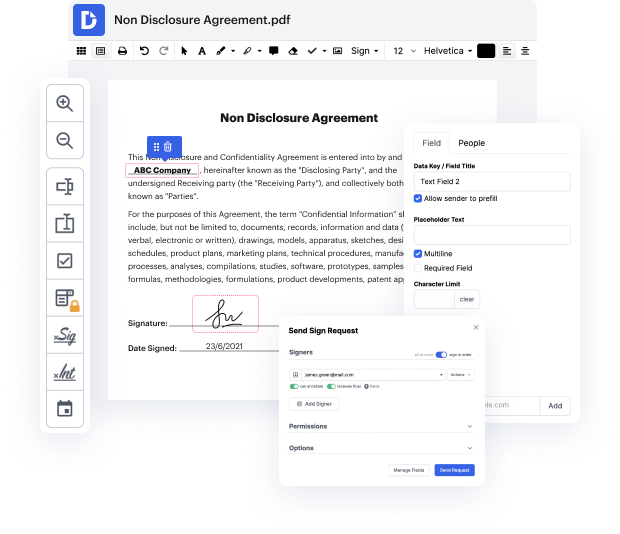

DocHub is an appropriately-developed PDF editor with a complete set of useful capabilities in one place. Altering, signing, and sharing forms is straightforward with our online solution, which you can access from any online device.

By following these five simple steps, you'll have your adjusted CWK rapidly. The intuitive interface makes the process quick and effective - stopping jumping between windows. Try DocHub today!

hey folks Iamp;#39;m talking today on FATCA vs. the common reporting standard the coming reporting standard is which is called CRS itamp;#39;s an information standard for the automatic exchange of information regarding bank accounts on a global level between tax authorities which the Organisation for Economic Cooperation and Development which is called the OECD developed in 2014 its purpose is to combat tax evasion the idea was based on the u.s. foreign account Tax Compliance Act which is FATCA 97 countries had signed an agreement to implement it with more countries intended to son later first reporting occurred in 2017 with many of the rest starting in 2018 until 2014 the parties to most treaties for sharing assets incomes and tax information internationally and shared it upon request which was not effective in preventing tax evasion the new system was intended to transfer all relevant information automatically and systematically the agreement has informally been referred to as Gatk