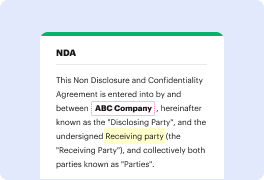

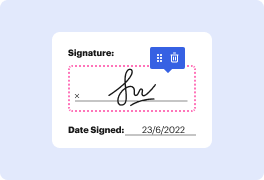

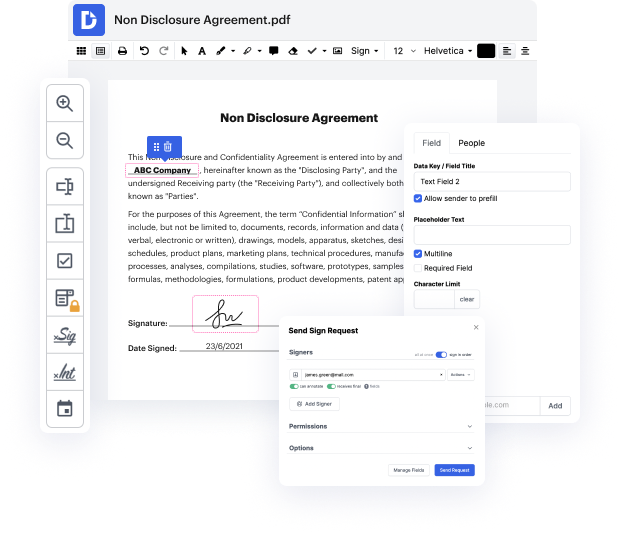

DocHub is an all-in-one PDF editor that lets you modify ein in rtf, and much more. You can underline, blackout, or remove paperwork elements, insert text and images where you want them, and collect information and signatures. And because it works on any web browser, you won’t need to update your device to access its professional features, saving you money. When you have DocHub, a web browser is all you need to manage your rtf.

Log in to our service and adhere to these guidelines:

It couldn't be easier! Streamline your document processing today with DocHub!

internal revenue service irs tax news irs businesses charities others with employer identification numbers must update responsible party information within 60 days of any change thereamp;#39;s a youtube video on this says five things to know about the employer identification number thereamp;#39;s a link to that here ir 2021-161 july 30th 2021 washington calling it a key security issue the internal revenue service today urged those entities with employer identification numbers eins to update their applications if there has been a change in the responsible party or contact information so the ein number can in essence be thought of the as like the social security number for a business itamp;#39;s the number that the irs identity identifies the business as although it says employer identification number which might lead you to believe that it has solely to do with the employer kind of portion of the business or even for businesses that have employees thatamp;#39;s not the case itamp;#