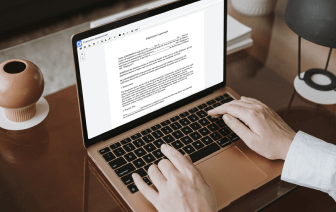

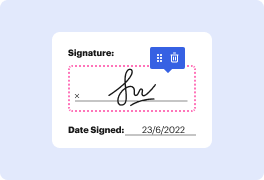

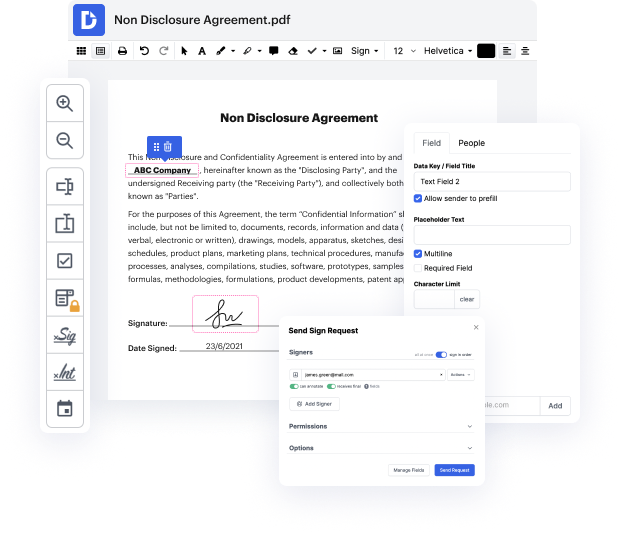

With DocHub, you can quickly modify ein in docx from any place. Enjoy features like drag and drop fields, editable textual content, images, and comments. You can collect electronic signatures safely, include an additional layer of defense with an Encrypted Folder, and work together with teammates in real-time through your DocHub account. Make changes to your docx files online without downloading, scanning, printing or sending anything.

You can find your edited record in the Documents tab of your account. Prepare, email, print, or convert your document into a reusable template. With so many powerful features, it’s simple to enjoy trouble-free document editing and management with DocHub.

foreign hello itamp;#39;s latina madison with tax savvy refunds company you know um i am here today because i have gotten so much feedback from you guys with what you need help on and itamp;#39;s contacting the irs trust me i know itamp;#39;s itamp;#39;s like a headache right but i have got the tips thatamp;#39;s going to get you the results you need really really fast so make sure you stay to the end make sure you like this video and share it with someone that needs this information and not to mention go ahead and tap that bell and subscribe to my channel get the alerts so that you can get the updates as soon as possible okay now that we got that out the way letamp;#39;s get to it so you want to know how to change your business information or your business contact with the irs without having to fill out that form that i showed you in the last video okay i got the tricks and the tips on how to do it so if you follow these directions just as i say youamp;#39;ll be very su