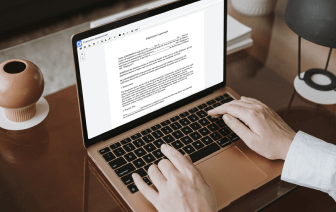

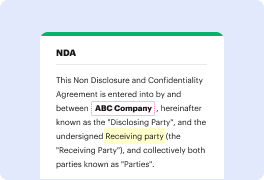

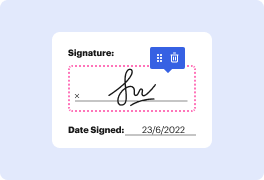

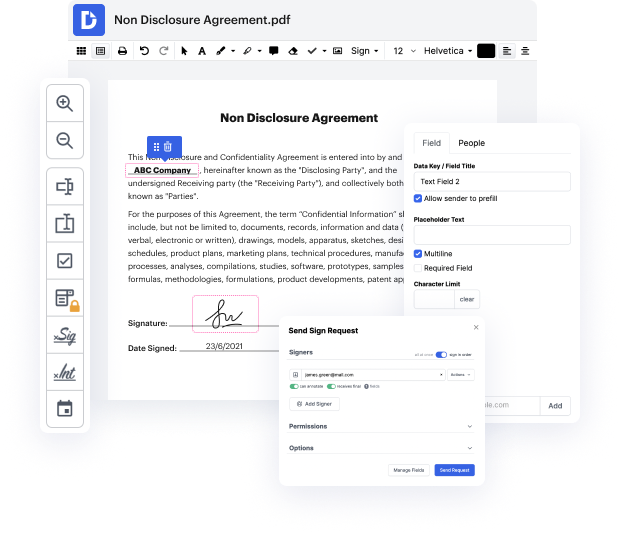

CCF may not always be the easiest with which to work. Even though many editing tools are out there, not all offer a straightforward solution. We created DocHub to make editing easy, no matter the form format. With DocHub, you can quickly and easily modify ein in CCF. In addition to that, DocHub gives a range of additional tools including document generation, automation and management, field-compliant eSignature tools, and integrations.

DocHub also helps you save time by creating document templates from documents that you use regularly. In addition to that, you can make the most of our a lot of integrations that enable you to connect our editor to your most used apps with ease. Such a solution makes it quick and easy to work with your files without any delays.

DocHub is a helpful feature for personal and corporate use. Not only does it offer a all-encompassing collection of tools for document generation and editing, and eSignature integration, but it also has a range of tools that come in handy for developing multi-level and simple workflows. Anything uploaded to our editor is stored secure according to major field criteria that shield users' information.

Make DocHub your go-to choice and streamline your document-driven workflows with ease!

hey guys so itamp;#39;s latino medicine again with tax every refunds company and i am here to teach you guys how to change your business name i get this question all the time all the time under all my videos how to change your business name so letamp;#39;s go ahead and talk about it letamp;#39;s learn about it so that you guys can be able to change your business name for free i probably should keep the teaching because my voice just didnamp;#39;t anyway okay letamp;#39;s go ahead and get started because itamp;#39;s a little bit more complex than just changing your name so i want to make sure that you fully understand exactly how to do it all right letamp;#39;s follow along make sure you have your pen and paper down because youamp;#39;re gonna need to jot down some information that pertains to you or i donamp;#39;t know screenshot pause take a picture whichever one that works best for you just get ready to take some good notes alright so the first thing that we need to know is