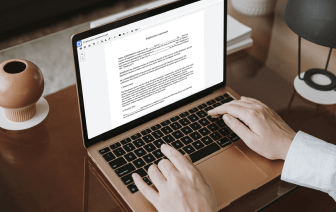

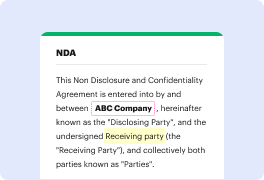

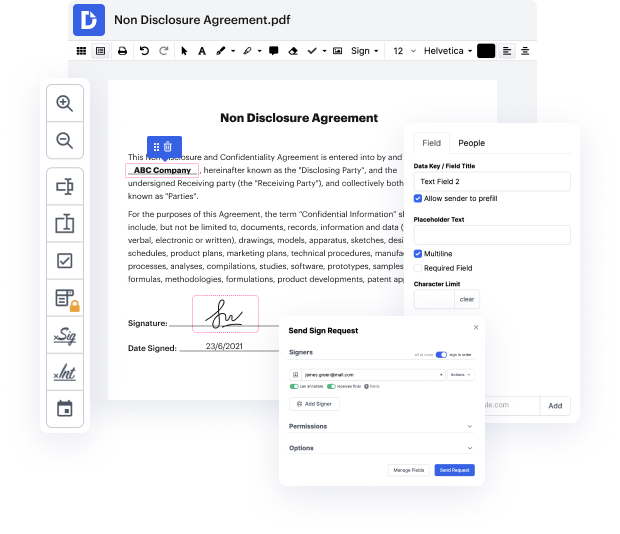

You know you are using the proper file editor when such a basic job as Itemize charter does not take more time than it should. Modifying papers is now a part of numerous working operations in various professional fields, which explains why convenience and simplicity are essential for editing instruments. If you find yourself studying guides or trying to find tips on how to Itemize charter, you may want to find a more easy-to-use solution to save your time on theoretical learning. And this is where DocHub shines. No training is needed. Just open the editor, which will guide you through its principal functions and features.

A workflow gets smoother with DocHub. Take advantage of this instrument to complete the documents you need in short time and get your efficiency to the next level!

Mark Kohler explains the difference between standard deduction and itemizing in the 1040 tax return. Starting in 2018 until 2023, you should compare your itemized deductions with your standard deduction and take the greater one. Generally, standard deductions are better. The standard deduction for singles is $12,000 and $24,000 for married couples. It's important to know the rules to determine which option is more beneficial for your tax return.