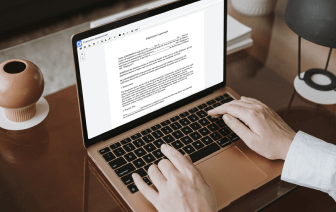

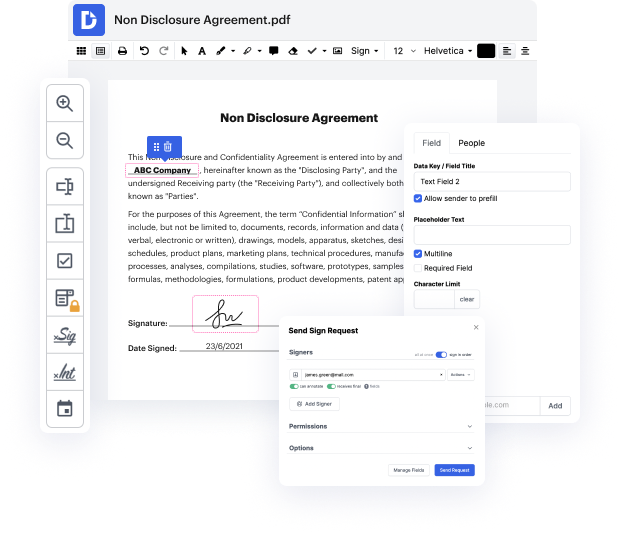

Time is a vital resource that each business treasures and attempts to convert into a gain. In choosing document management software, focus on a clutterless and user-friendly interface that empowers consumers. DocHub delivers cutting-edge tools to optimize your file managing and transforms your PDF editing into a matter of one click. Insert SNN Field into the Exchange Of Shares Agreement with DocHub in order to save a ton of efforts and boost your efficiency.

Make PDF editing an simple and easy intuitive process that saves you a lot of precious time. Quickly alter your documents and send out them for signing without looking at third-party solutions. Give attention to pertinent tasks and boost your file managing with DocHub starting today.

Hello everyone! Today we are going to talk about How to draft a Shareholders Agreement? Shareholders agreements only apply to companies with more than one shareholder. So if you have a company that has two or more shareholders you should look at putting in place a shareholders agreement. So what is a shareholders agreement? Well as this slide says its a contract between the shareholders that sets out the rights and responsibilities of the shareholders. Generally a shareholders agreement can cover things like, How many shares do each shareholder? or Does each shareholder own. It could set out whether there are different classes of shares and if so the rights and responsibilities that are applicable to each different share class. Often though the constitution can also set out the share class information, so thats not necessarily in a shareholders agreement but can be in there. A shareholders agreement can set out whether or not the company is able to issue additional shares in the fut