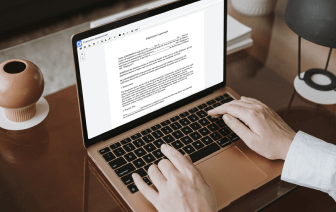

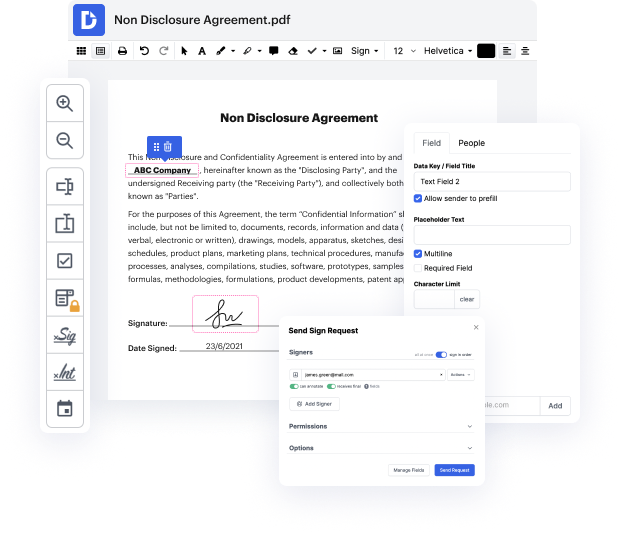

Time is an important resource that every business treasures and attempts to turn into a benefit. When picking document management software program, be aware of a clutterless and user-friendly interface that empowers customers. DocHub provides cutting-edge tools to optimize your file administration and transforms your PDF file editing into a matter of one click. Insert SNN Field in the Exchange Of Shares Agreement with DocHub to save a lot of efforts and improve your productivity.

Make PDF file editing an simple and easy intuitive operation that will save you plenty of valuable time. Quickly change your documents and deliver them for signing without switching to third-party alternatives. Give attention to relevant tasks and improve your file administration with DocHub starting today.

and concerning the world cup you said youre looking forward to to the german guests are you also looking forward to homosexual german guests or do they have to stay home listen everybodys welcome in doha we do not stop anybody from coming to the half with any different backgrounds any different believe qatar is a very welcoming country and the world cup is a great opportunity for people from different parts of the world to come and experience our culture we will not stop anybody from coming visiting and enjoying the football we all live in one planet but each of us have different cultures we welcome everybody but also we expect and we want people to respect our culture