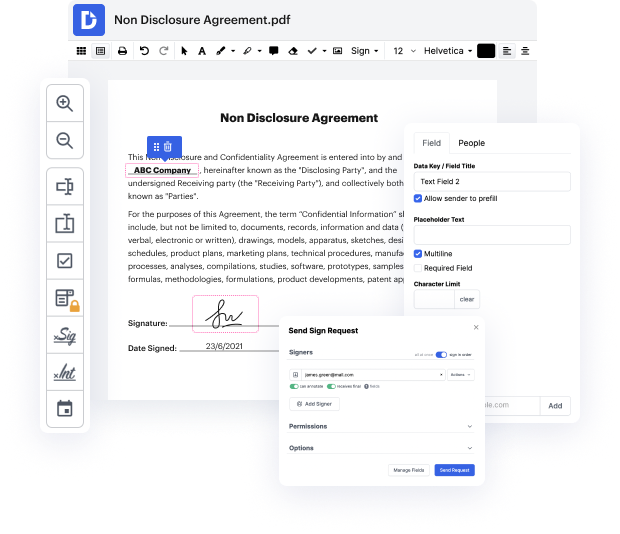

Time is a vital resource that every enterprise treasures and attempts to change in a advantage. When choosing document management software program, be aware of a clutterless and user-friendly interface that empowers users. DocHub offers cutting-edge tools to improve your file managing and transforms your PDF file editing into a matter of a single click. Insert Payment Field to the Senior Pastor Application with DocHub in order to save a ton of efforts and increase your productiveness.

Make PDF file editing an simple and easy intuitive operation that saves you a lot of valuable time. Quickly modify your documents and deliver them for signing without the need of switching to third-party software. Concentrate on relevant tasks and increase your file managing with DocHub right now.