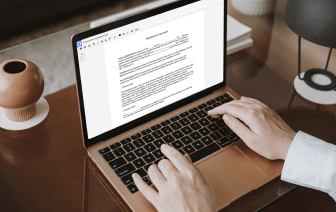

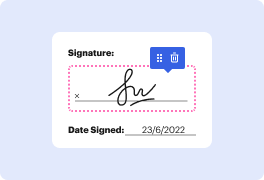

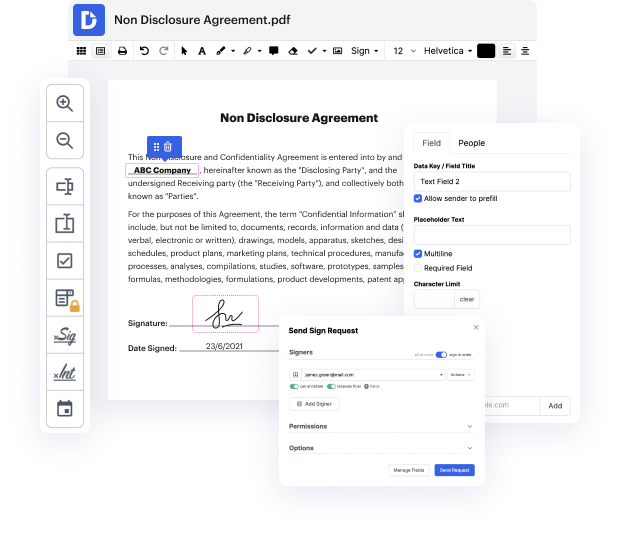

Time is a crucial resource that each organization treasures and tries to turn into a advantage. In choosing document management application, focus on a clutterless and user-friendly interface that empowers consumers. DocHub provides cutting-edge tools to enhance your document management and transforms your PDF editing into a matter of a single click. Insert Demanded Field to the Liquidity Agreement with DocHub to save a lot of time and boost your productivity.

Make PDF editing an easy and intuitive operation that will save you a lot of valuable time. Easily alter your files and give them for signing without the need of looking at third-party solutions. Concentrate on pertinent duties and boost your document management with DocHub starting today.

this is frm part 2 book 4 liquidity and treasury risk measurement and management and the chapter on liquidity risk this chapter is taken from one of the john hall textbooks and we read some of his chapters before and i bet i told you that i have used his textbooks in my derivative securities classes before and his chapters and his textbooks uh tend to be highly technical and this chapter it it kind of wants to get technical but it falls just a little bit short of uh of any kind of mathematical complexity youll see that when when we get to a future slide but look at the learning objectives uh just four of them the good news for those of you who are technical is that there is an explain and calculate and were going to add you know kind of a liquidity adjustment to our traditional and regular old value at risk and were going to look at a couple of cases actually three of them one of which was a longer case that i believe we discussed at great lengths back in part one and well go ahead