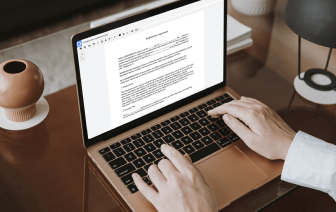

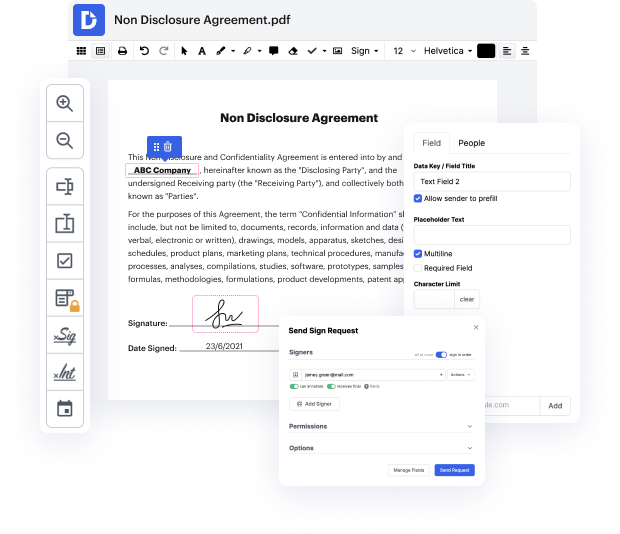

Time is a vital resource that each enterprise treasures and tries to change into a advantage. When selecting document management application, focus on a clutterless and user-friendly interface that empowers consumers. DocHub gives cutting-edge instruments to optimize your document administration and transforms your PDF editing into a matter of a single click. Insert Checkbox Group into the Deferred Compensation Plan with DocHub in order to save a lot of time as well as improve your productiveness.

Make PDF editing an easy and intuitive operation that saves you plenty of precious time. Effortlessly adjust your documents and send out them for signing without turning to third-party solutions. Give attention to relevant tasks and improve your document administration with DocHub starting today.

hi this is Wayne Wagner from Visionary wealth management today were going to talk about your deferred comp plan so many of our clients have access to Executive Deferred Comp plans DCP edcp theres a thousand other acronyms they all function the same way youre given an opportunity once a year usually in the third or fourth quarter to opt into the deferred comp plan for next year so not only are you trying to do your family budget and plan family vacations and all that kind of stuff youre trying to figure out what part of next years compensation should you be putting away until some indeterminate point in the future most often people choose a lump sum at retirement or defer that money into an account that maybe is going to pay out during the first 10 years of retirement to help with the income or cash flow stream for those first-time years of retirement as clients have been more transient moving between companies these things very often get paid out as lump sums when you leave your c