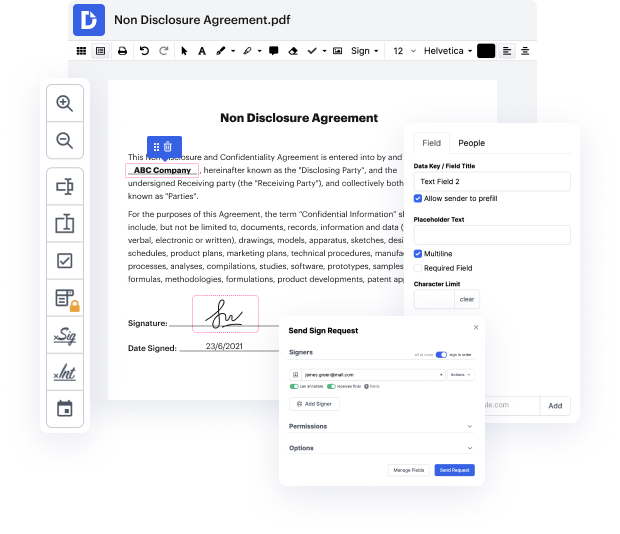

Time is an important resource that every company treasures and tries to convert into a reward. When picking document management software, pay attention to a clutterless and user-friendly interface that empowers users. DocHub offers cutting-edge instruments to maximize your file administration and transforms your PDF file editing into a matter of a single click. Insert Calculated Field from the Notice Of Withdrawal From Partnership with DocHub in order to save a ton of time as well as improve your productiveness.

Make PDF file editing an simple and intuitive process that will save you plenty of precious time. Effortlessly modify your files and send out them for signing without the need of switching to third-party solutions. Concentrate on pertinent tasks and increase your file administration with DocHub today.

oh and welcome to the session this is Professor for health in this session we would look at a withdrawal of a partner thus topic is covered in financial accounting as well as an advanced accounting course also covered on the CPA for section as always I would like to remind you to connect with me on LinkedIn if you havent done so YouTube is where you would need to subscribe i have 1700 plus accounting auditing tax and finance lectures as well as excel tutorial if you like my lessons please like them share them subscribe to the channel if they benefit you it means they might benefit other people share the wealth connect with me on instagram on my website for head lectures calm you will find additional resources to supplement your accounting education and if you are looking to pass your CPA exam add those 10 at the 15 points check out my website in this session were going to be looking at a withdrawal of a partner in contrast that the prior session will be looked at an admission so a pa