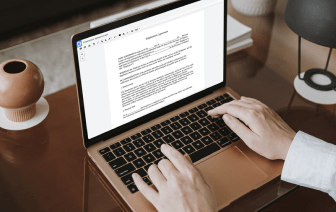

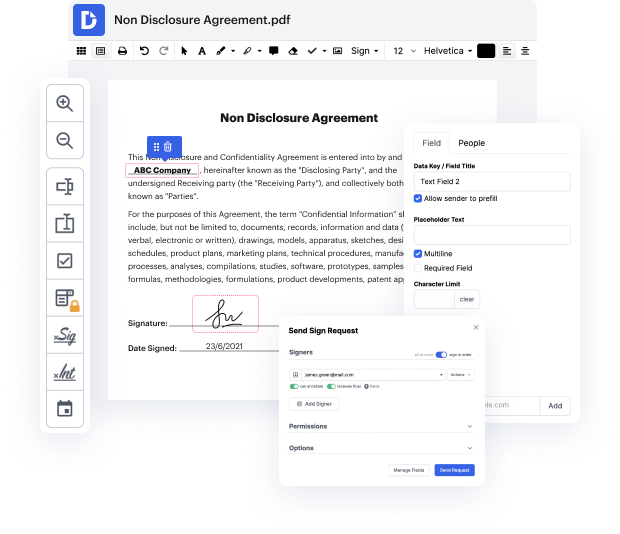

Time is an important resource that every company treasures and attempts to transform into a reward. When selecting document management software program, focus on a clutterless and user-friendly interface that empowers customers. DocHub offers cutting-edge features to enhance your document managing and transforms your PDF file editing into a matter of one click. Insert Amount Field into the Letter Bankruptcy Inquiry with DocHub to save a lot of efforts and increase your efficiency.

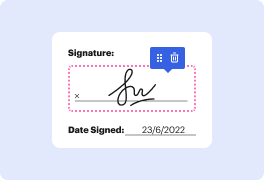

Make PDF file editing an simple and easy intuitive process that saves you plenty of valuable time. Effortlessly change your files and give them for signing without the need of turning to third-party solutions. Give attention to relevant tasks and boost your document managing with DocHub today.

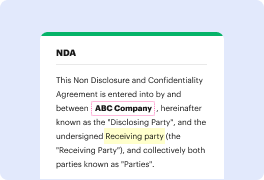

so you finally received that infamous u.s bankruptcy court verification letter stating that the u.s bankruptcy courts do not furnish information to credit bureaus or consumer reporting agencies nor do they verify public information such as bankruptcies so now that you received the letter what do you do with it [Music] so im pretty sure that if youre watching this video youve either either you have sent in this u.s bankruptcy court letter to the credit bureaus and have gotten nowhere or youre just getting started and youre trying to figure out what to do so heres what im doing okay so as you know like the credit repair world is constantly changing because we basically have to try to keep one or two steps ahead of the credit bureaus and the consumer reporting agencies legitly of course so this is what ive been doing lately lately when i receive my letters back from the bankruptcy courts stating that they do not verify any bankruptcy information instead of sending it straight into