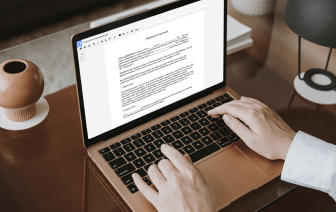

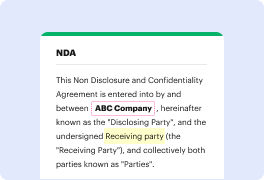

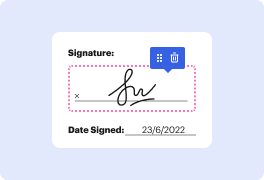

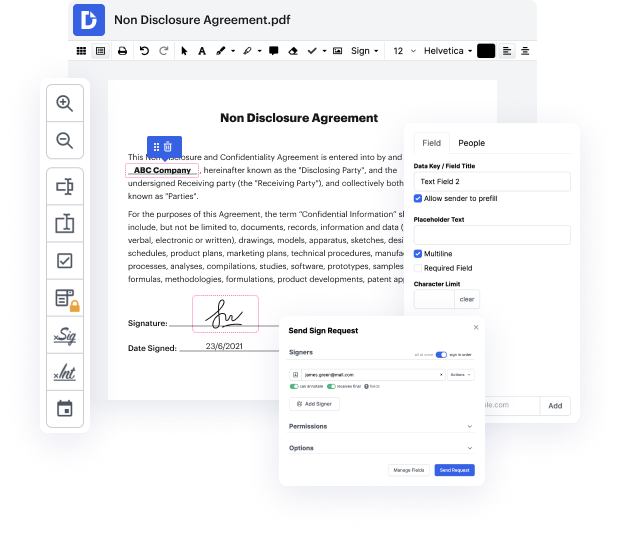

Time is an important resource that every enterprise treasures and tries to convert in a reward. When selecting document management software program, be aware of a clutterless and user-friendly interface that empowers customers. DocHub gives cutting-edge instruments to improve your file administration and transforms your PDF editing into a matter of a single click. Hide Symbols into the Mortgage Quote Request with DocHub in order to save a lot of time as well as increase your efficiency.

Make PDF editing an easy and intuitive operation that saves you plenty of precious time. Easily adjust your files and deliver them for signing without turning to third-party alternatives. Concentrate on pertinent tasks and enhance your file administration with DocHub today.

this is democracy now democracynow.org the war and peace report Im Amy Goodman with Juan Gonzalez how to hide an empire a history of the greater United States thats the title of a stunning new book looking at a part of the USA is often overlooked the nations overseas territories from Puerto Rico to Guam former territories like the Philippines and its hundreds of military bases scattered across the globe historian Daniel innovar writes in his new book at various times the inhabitants of the US Empire have been shot shelled starved intern dispossessed tortured and experimented on what they havent been by and large is seen he writes Daniel M revoir is associate professor of history at Northwestern University in Chicago he joins us from Chicago welcome to Democracy Now its great to have you with us why dont you start with the title how to hide an empire how do you do it and what a history of the greater United States means yeah so when a lot of people think about the United States p