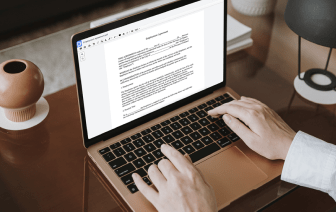

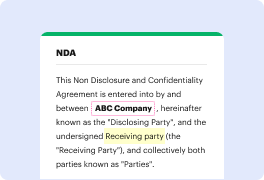

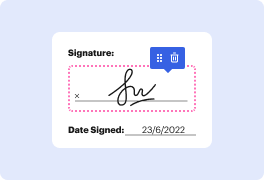

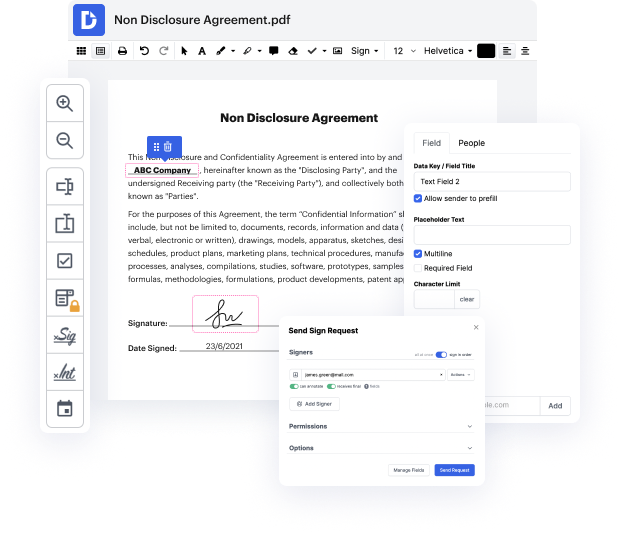

Time is a crucial resource that every company treasures and attempts to transform in a reward. In choosing document management application, pay attention to a clutterless and user-friendly interface that empowers consumers. DocHub delivers cutting-edge instruments to improve your file management and transforms your PDF editing into a matter of a single click. Hide Surname Field in the Mortgage Quote Request with DocHub in order to save a lot of time and improve your efficiency.

Make PDF editing an easy and intuitive process that helps save you a lot of precious time. Effortlessly alter your documents and send out them for signing without the need of looking at third-party software. Focus on pertinent duties and improve your file management with DocHub starting today.

you may have heard the news already but the mortgage interest rates have just come down todays rate is about 6.15 so its down quite a bit and this is obviously good news because its going to help affordability so just for some sample payments if you havent been running numbers lately to see what payments would be on a hundred thousand dollar loan at 6.15 percent for a normal 30-year loan your payment would be about 609 dollars a month a 200 000 loan at six point one five percent your monthly payment would be about 1218 a month and on a 300 000 loan your monthly payment uh for 300 000 at six point one five percent on a thirty year would be about eighteen twenty seven a month so um this is a move in the right direction its going to help affordability its going to make the monthly payments lower but its also going to make it easier for you to qualify to get a home loan so Im seven dollar Remax Stars Realty Ill come back to you with another one tomorrow