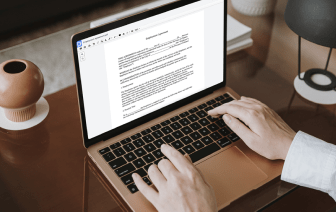

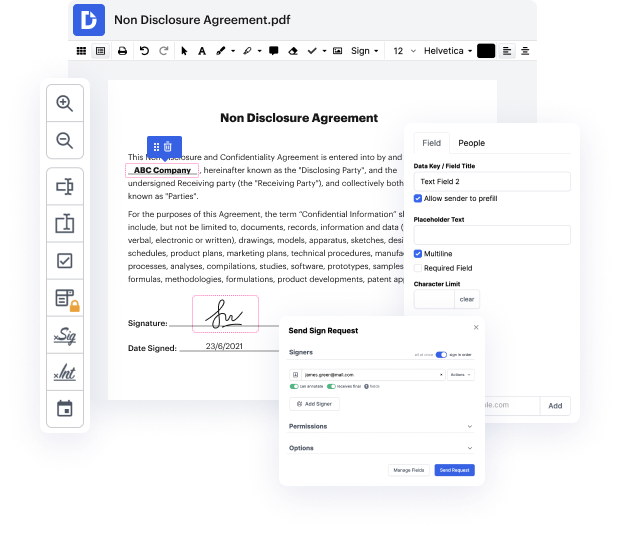

Time is a vital resource that each business treasures and attempts to change into a reward. When picking document management software program, take note of a clutterless and user-friendly interface that empowers consumers. DocHub delivers cutting-edge features to enhance your file management and transforms your PDF editing into a matter of a single click. Hide Name Field to the Letter Bankruptcy Inquiry with DocHub in order to save a lot of time and increase your efficiency.

Make PDF editing an simple and intuitive operation that saves you plenty of valuable time. Easily modify your documents and deliver them for signing without adopting third-party options. Focus on pertinent tasks and boost your file management with DocHub right now.

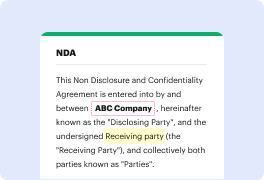

i got one good question for you did you know you dont have to wait seven to ten years to knock that bankruptcy off your credit report yes we dont have 17 years of waste and im going to show you step by step by step on how to not that bankruptcy so you can get that house or whatever youre trying to do with credit so with that being said you already know what timing is thats guarding two rounds whats up family im back with another one hey if youre new to the channel welcome to the family so you asked im about to deliver so in todays class youre going to learn that chicos on how to knock that bankruptcy off your current report step by step by step so make sure you grab a pen go get some paper and you know were gonna get some gatorade today so this class is gonna be a good one hey welcome to todays clash show i have an eight part system thats gonna walk you step by step by step so you know i created a flow chart so you can understand on the flow and how to do everything righ