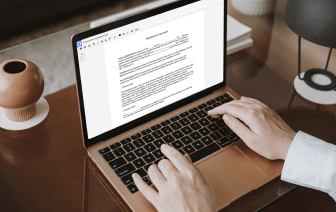

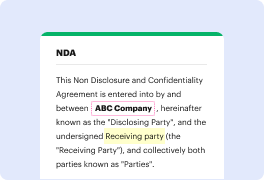

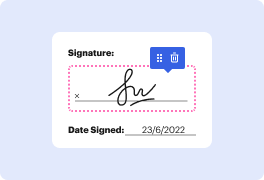

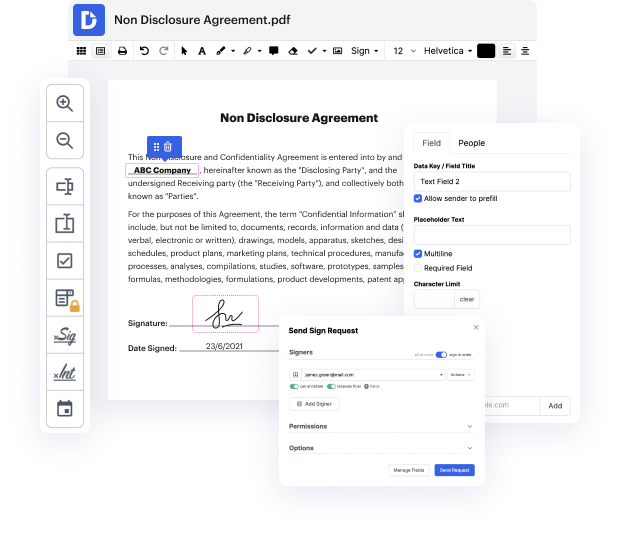

Time is a crucial resource that every enterprise treasures and attempts to convert in a benefit. When choosing document management software, pay attention to a clutterless and user-friendly interface that empowers consumers. DocHub offers cutting-edge instruments to improve your file administration and transforms your PDF file editing into a matter of a single click. Hide Initials Field from the Mortgage Quote Request with DocHub to save a lot of time as well as enhance your efficiency.

Make PDF file editing an simple and intuitive process that saves you plenty of valuable time. Easily alter your files and deliver them for signing without turning to third-party alternatives. Concentrate on relevant duties and enhance your file administration with DocHub right now.

all right good evening everyone see a lot of people were already there in the chat sorry for the delay for a couple minutes but were here go ahead and drop a comment there and let us know that youre here too and well just wait a couple minutes to get live on all the different platforms here appreciate everybody tuning in for their midweek sales training this is uh always my favorite training talking about actually getting out there and getting some deals making some things happen all right hello everybody there in the chat good evening good evening just gonna wait one more minute here to go live on all the different platforms and then well get started all right some more people checking in there hello hello good evening all right looks like we are good to go so lets go ahead and get it started welcome everyone my name is Kyle Hershey Im the CEO of the mortgage calculator joined by our President Nick Hershey and our sales manager Jose Gonzalez today we are going to do our loan off