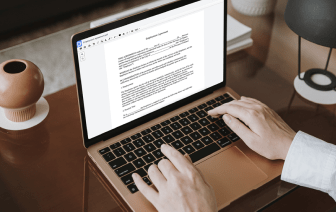

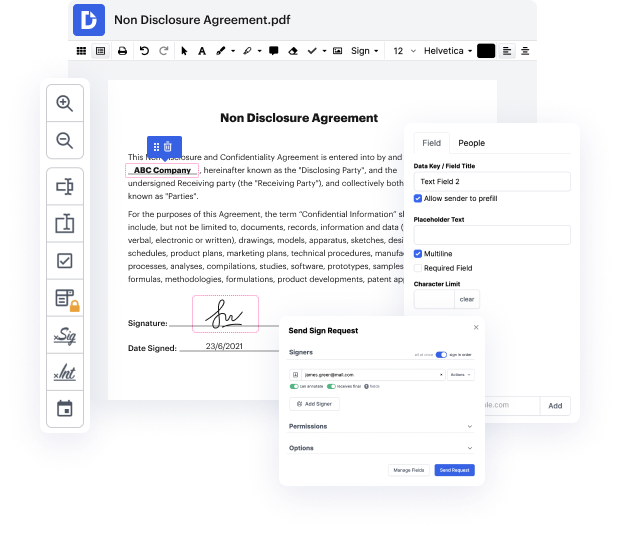

Time is an important resource that each business treasures and tries to convert in a benefit. When choosing document management application, be aware of a clutterless and user-friendly interface that empowers consumers. DocHub delivers cutting-edge features to improve your file administration and transforms your PDF file editing into a matter of one click. Hide Calculated Field from the Bridge Loan Agreement with DocHub to save a ton of time and improve your efficiency.

Make PDF file editing an simple and intuitive operation that helps save you a lot of precious time. Easily change your files and give them for signing without having looking at third-party software. Concentrate on pertinent duties and increase your file administration with DocHub starting today.

how quickly can you close with the bridge lawn well our regular closing time is about 14 to 17 days but were able to close in less than seven days if necessary our team is amazing and they love making our clients and real estate partners happy by closing quickly we even set a new record a few weeks ago with a three day closing it was crazy but its definitely possible always call me and i can tell you within just a few hours if we can get it done within your timeline we love making magic happen you